In fiscal 2024, OMRON embarked on the first year of structural reform, focusing on strengthening the foundation for earnings and driving the regrowth of IAB, with the goal of achieving an early recovery of financial performance.

First, let me address the strengthening of the foundation for earnings. The main measures are: 1) Optimization of headcount and labor cost through voluntary retirements on a global scale, 2) Rationalization of indirect costs by dissolving the Asia Pacific and North America regional headquarters, and 3) Incorporation of a joint venture with transcosmos inc. to enhance the efficiency and quality of domestic back-office operations. Through these initiatives, we expect cumulative cost reductions of JPY 35.4 billion over two years. This is not merely a short-term cost-cutting measure, but a fundamental structural reform aimed at sustaining our competitiveness into the future.

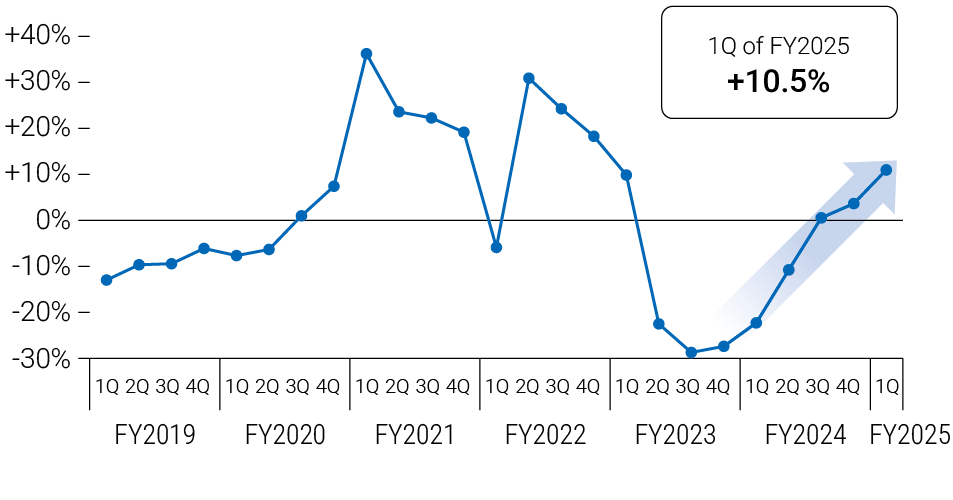

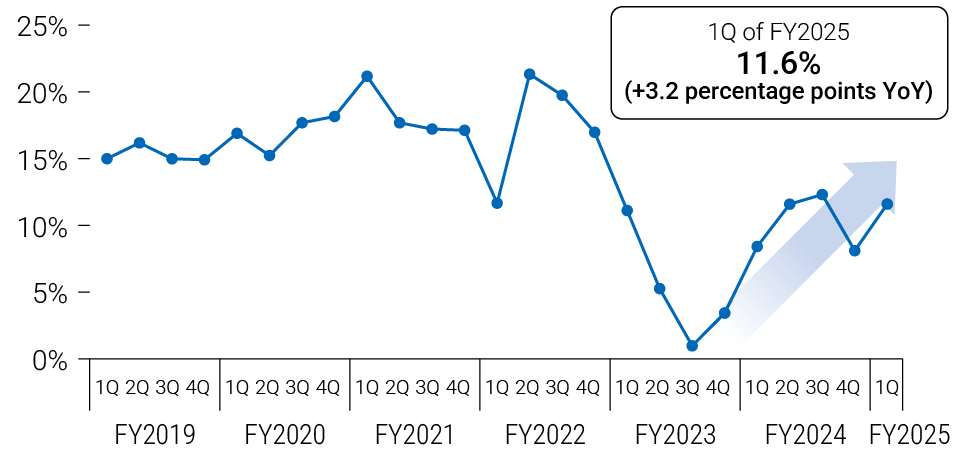

Next, the regrowth of IAB. In the first quarter of fiscal 2025, IAB’s net sales rose 10.5% year on year, and operating income margin improved by 3.2 percentage points, showing signs of recovery. However, this is only the first step toward regrowth. While the benefits of strengthening partnerships with distributors and launching new products have begun to appear, results have yet to reach past levels. We recognize that in order to achieve sustainable profit growth, it is essential to further strengthen our competitive advantages to overcome an uncertain and unpredictable external environment. (See Figure 1)

IAB sales growth rate (YoY)

IAB operating income margin

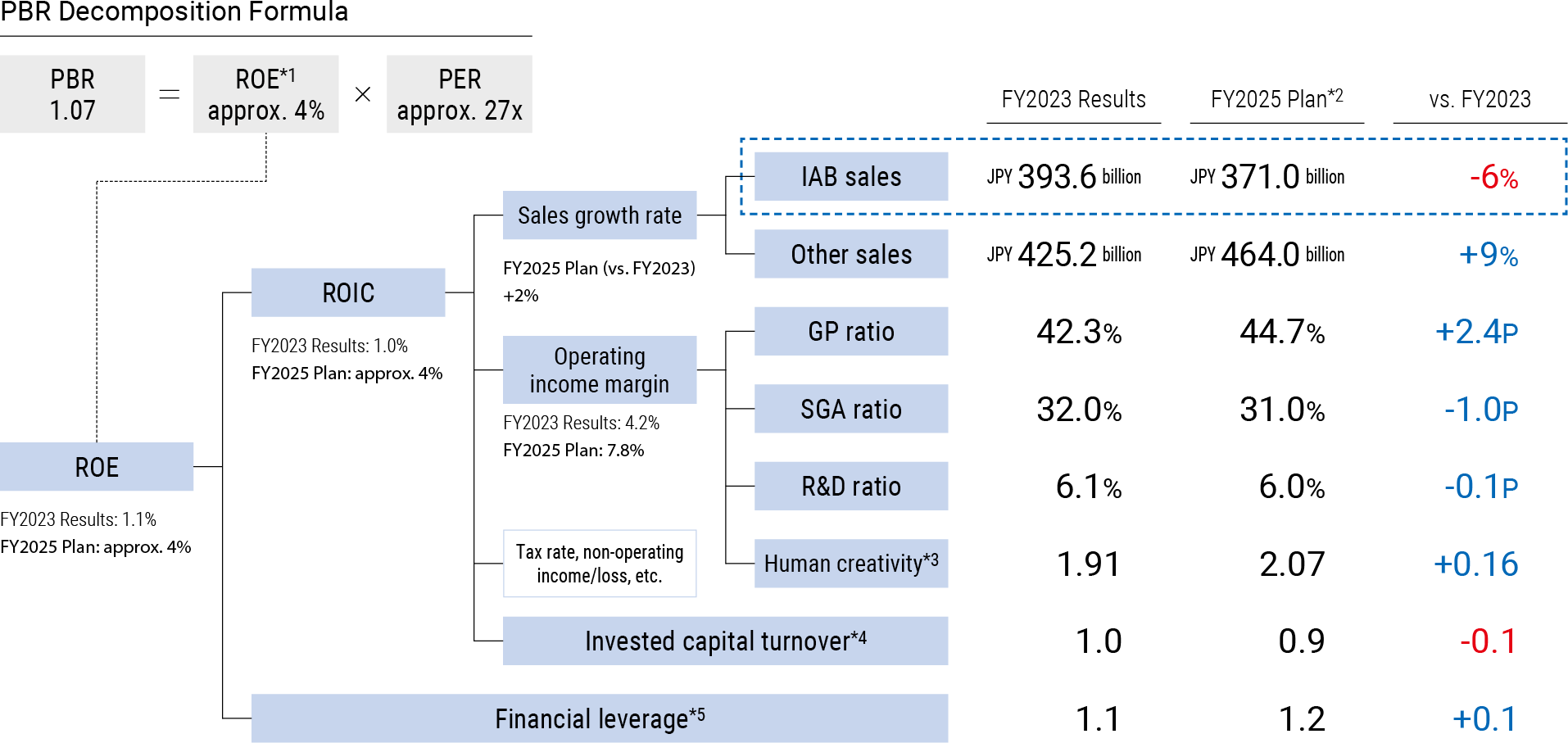

Currently, OMRON’s share price is sluggish, and PBR at the end of fiscal 2024 remains at a low level of 1.07x. I take this fact very seriously. I understand that the major reason for this is not that the results of our earnings structural reforms have not been recognized, but that we have not been able to fully demonstrate sustainable growth beyond them. Furthermore, while some improvement in ROE, which is a component of PER, is expected due to the elimination of structural reform costs and improvements in the GP and SGA ratios, it still has not reached past levels. The fundamental cause of this is the stagnation of our sales, particularly the insufficient growth of the Industrial Automation Business, which is the growth driver for the OMRON Group. We have continued to invest in strengthening the Industrial Automation Business in the past, but our investments were insufficient in developing the devices that are the foundation of our competitive advantage and in IT towards strengthening our sales capabilities to deliver products according to customer needs. In other words, our investments in the solutions domain were relatively large, leading to a lack of balance. Currently, we are thoroughly focusing on the fundamentals: refining the devices that are the source of our competitive advantage and responding quickly to customer needs. It has also been pointed out that ROE and ROIC have temporarily declined due to the acquisition of JMDC. However, we believe that in this business domain, we should prioritize market creation and position establishment through upfront investment. By steadily achieving our initial milestones from this fiscal year onward, we will achieve improved capital efficiency and greater shareholder value over the medium to long term (See Figure 2).

*1 ROE is the FY2025 planned value

*2 The FY2025 plan applies the upper-end values of the financial performance range

*3 Calculated by: value added √∑ labor cost

*4 Calculated by: net sales ÷ (total shareholders’ equity + borrowings). Total shareholders’ equity and borrowings are the average of the beginning and end of the period

*5 Calculated by: (total shareholders’ equity + borrowings) ÷ total shareholders’ equity. Total shareholders’ equity and borrowings are the average of the beginning and end of the period

Now that we have gone through structural reform, in order for OMRON to realize the returns demanded by the market, we must directly address the fundamental challenge of growth through value creation. The key to this is the advancement of business portfolio management.

OMRON currently has five segments, and we believe that it is essential to further enhance our portfolio management to maximize growth across the Group. As before, we will continue to identify businesses with challenges from the perspective of profitability and capital efficiency, and take the necessary actions. Even during the process of structural reform, we have conducted multifaceted reviews of multiple businesses and are already proceeding with decision-making and implementation. We will provide details when they can be disclosed.

On the other hand, for growth, we will engage in management that pursues growth by implementing a more targeted capital allocation strategy, centered on market growth potential, earnings growth potential, and compatibility with the companywide strategy (expansion of the data business domain). As mentioned previously, we have positioned the Industrial Automation Business as the Group’s growth driver and are placing the highest priority on establishing a companywide system and investment allocation, but for sustainable growth, we must also strengthen device businesses with competitiveness and profitability in other segments, as well as make timely investments in the data business, which will be a future pillar.

OMRON has businesses at various stages, from those that have reached maturity and generate stable earnings to those in the nascent stage with expected future growth. Rather than evaluating each using a single metric, we need to establish flexible standards according to their stage and role. For the mature device business, we will continue investing efficiently and strengthening competitiveness while placing importance on capital efficiency and maintaining profitability, using indicators such as ROIC. On the other hand, new businesses such as data services and manufacturing DX with Cognizant should not be evaluated using the same metric as existing businesses; we will adopt standards that correctly measure long-term growth potential, such as EBITDA growth and strategic KPI achievement.

OMRON’s fundamental approach to portfolio management is to integrally manage businesses at different stages and optimally allocate resources. We will achieve long-term enhancement of corporate value by striking a balance between stability and growth. To enhance its effectiveness, in addition to establishing an evaluation system, we will place importance on the ability to assess the practicality of strategies and on strengthening the capabilities of our organization and human resources. Based on the new framework we have established through structural reform, we will move to the implementation stage from the next fiscal year onward and accelerate our growth strategy.

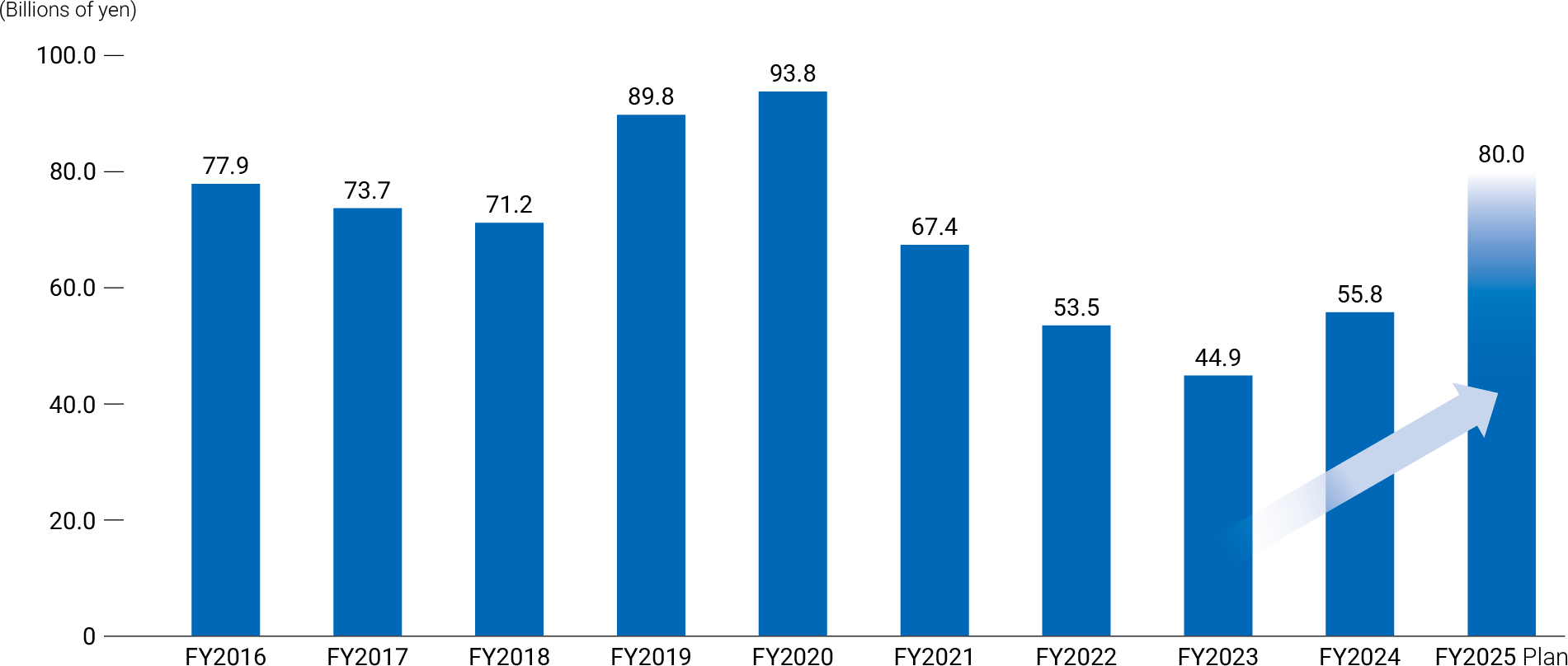

For fiscal 2024, by eliminating one-time structural reform costs and thoroughly managing inventory, we plan for approximately JPY 80.0 billion in operating cash flow, and expect it to recover to near previous levels. We appropriately manage our balance sheet to ensure its soundness, with a D/E ratio of 0.2x and a net interest-bearing debt to EBITDA ratio of 0.4x at the end of fiscal 2024. In the future, to balance further strengthening growth and expanding shareholder returns, in addition to continuous earnings improvement, we will thoroughly improve asset efficiency, such as by shortening the cash conversion cycle, and further enhancing our cash-generating capability (See Figure 3).

This fiscal year’s capital allocation will be executed in accordance with our conventional policy, with top priority given to focused investment in growth businesses, including IAB. Shareholder returns will be implemented with an emphasis on stability and continuity, based on a DOE of approximately 3%. Furthermore, we have recorded JPY 185.0 billion in interest-bearing debt at the end of fiscal 2024, but we will continue to maintain a sound financial foundation while proceeding with financial management that utilizes leverage. Even in cases where invested capital increases in the short term with M&A opportunities in view, we will position ROE in addition to ROIC as a performance indicator, and will pursue the maximization of shareholder value. We will also continue to thoroughly implement management based on the down-top ROIC tree and PPM, and aim for the early achievement of our WACC level by improving margins and asset efficiency.

Last fiscal year, OMRON positioned its IR activities as ‚Äúdeepening dialogue,‚ÄĚ and the management team themselves conducted IR tours and analyst meetings in Japan, the U.S.,Europe, and Asia. Being able to directly discuss the progress of structural reform and the path to enhancing corporate value with market participants was extremely beneficial in honing our execution capabilities.

In July of this year, we concluded a partnership agreement with Japan Activation Capital, Inc. (JAC). Sharing the common goal of enhancing corporate value, JAC is providing focused support, especially for the Industrial Automation Business, by leveraging its strengths in hands-on involvement in execution. The transformation of the Industrial Automation Business is not easy due to the influence of past business practices and other factors, but by adopting a market perspective and through disciplined management based on return on investment, we will accelerate the pace of change.

Lastly, OMRON is currently formulating a new equity story, which we plan to announce this autumn, and we would like to share our vision beyond structural reform and the path to its realization. We are not aiming for a one-time recovery, but for the establishment of a sustainable and capital-efficient growth model. By reliably demonstrating our achievements, we will regain trust from the market and steadily pave the way to enhancing shareholder value. We look forward to sharing our future developments.