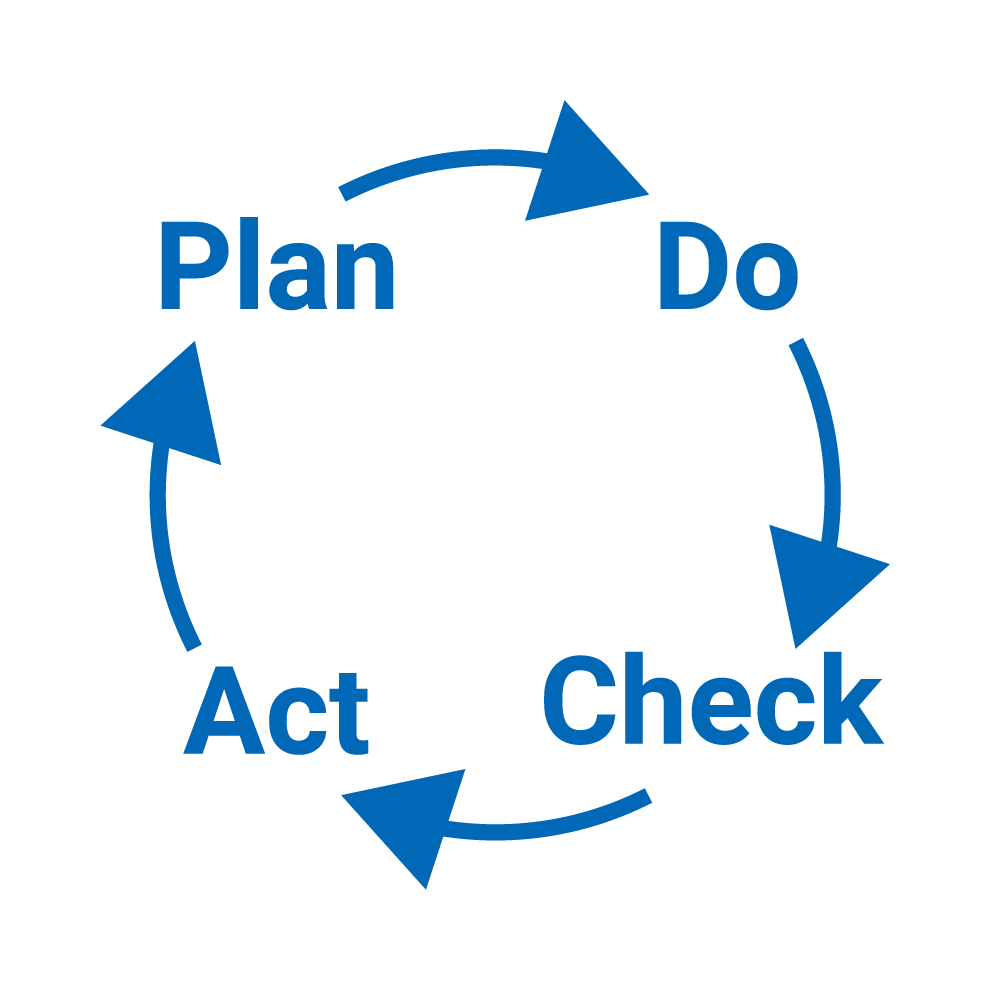

OMRON implements integrated risk management under a common framework throughout the Group. To be able to swiftly adapt to the rapidly changing management and business environment, as well as rising uncertainty, we must increase our risk sensitivity and identify and address risks before they become apparent. We aim for active risk management where front-line employees and management work together to solve problems arising from changes in the environment that cannot be addressed by front-line employees alone. We are implementing a PDCA cycle globally to improve the quality of this activity. We are additionally considering how to equip ourselves with mechanisms enabling efficient, effective, and prompt risk decisions while still adhering to the OMRON Principles and relevant business rules in order to achieve our long-term vision SF2030.

Corporate Ethics & Risk Management Committee

Execute Plan

Board of Directors

Executive Council

Analyze Global Risk

Corporate Ethics & Risk Management Committee

Externally Disclose Results of Activities

Under the internal control system, the framework for integrated risk management is summarized in the OMRON Group Rules (OGR) for Integrated Risk Management, which clarify the position of the risk management framework within Group management. The Senior General Manager of the Global Risk Management and Legal HQ (GRL Manager) is in charge of its promotion. Additionally, risk managers (approximately 150 in total) have been appointed for head office divisions, business companies, overseas regional management and Group companies across the world, to help promote initiatives on a global scale through the concerted effort of management and front- line employees. The three main activities are as follows:

In order to promote ethical practices and risk management, we have established the Corporate Ethics & Risk Management Committee, which is chaired by the GRL Manager and comprised of key risk managers, and meets four times a year, in principle, under the participation and supervision of Directors and Audit & Supervisory Board Members. The status of the integrated risk management activities is reported to the Executive Council and the Board of Directors for regular evaluation and monitoring.

Under SF2030, OMRON aims to solve social issues that arise in the transition to a new social and economic system. To this end, we are working to create social value in business domains and are implementing initiatives integrating sustainability with business. We consider the key factors that must be addressed in the execution of these initiatives to be risks. In operating the OMRON Group, we have identified the following two Group Critical Risks. S Rank: Risks of utmost importance to the operation of the Group, which may jeopardize its survival or result in severe social liability, A Rank: Risks that impede the achievement of important Group goals. In order to keep these risks at an acceptable level without letting them materialize, we monitor environmental changes and the status of implementation of measures.

The themes of Group Critical Risks based on the OMRON Group’s risk analysis conducted at the end of fiscal 2024 are presented in the web link below. We will continue to pay particular attention to risks associated with the execution of NEXT 2025, as well as Group governance and compliance risks as we seek to accelerate business growth and improve profitability. For the priority themes addressed by the OMRON Group, risk scenarios and countermeasures for the risks are presented in the Annual Securities Report (pages 48-55). For further details, please refer to the Annual Securities Report.