OMRON’s officer compensation plan, which is based on the structure introduced in fiscal 2017, has been revised for the second time after the first revision in 2021. This structure aims to reflect the perspectives of all stakeholders, including shareholders, in OMRON’s management. By clarifying the linkage between officer compensation and improved corporate value (business value, shareholder value, and social value), we motivate officers to achieve the performance targets. We also maximize their motivation to contribute to the sustainable improvement of corporate value by encouraging them to hold the company’s stock.

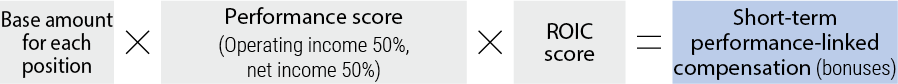

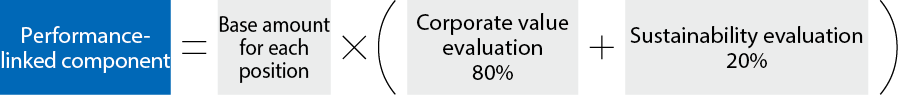

Specifically, officer compensation consists of a base salary, or fixed compensation; short-term performance-linked compensation (bonuses) that varies depending on the company’s performance; and medium-to-long-term, performance-linked compensation (stock compensation). The base salary is determined at a level that ensures objectivity, based on the compensation data of over 100 major companies in Japan surveyed by a specialized outside organization. In addition, the composition ratio of each performance-linked compensation to base salary is determined according to each officer’s position, role, and responsibility. For example, the ratio for the CEO, who commits to enhancing medium- to long-term corporate value and is responsible for driving sustainable growth, is 1:1:1.7 (base salary : bonuses : stock compensation). This structure emphasizes performance-linked compensation, particularly with a relatively higher ratio allocated to the medium to long term. By having a composition focusing on medium- to long-term performance in addition to short- term performance, the structure provides stronger incentive for contributing to sustained improvements in corporate value.

(Referring to the President and CEO, the ratio is based on the assumption that the performance targets are set as 100% for each performance-linked compensation)

The evaluation period of the medium-to-long-term, performance-linked compensation (stock compensation) started in fiscal 2021 and ended in fiscal 2024. On this occasion, we comprehensively reviewed the compensation plan. The revision was decided upon after deliberation of the Compensation Advisory Committee, which is composed of members the majority of whom are Outside Directors, and is chaired by an Outside Director.

The basic policy for the revision is to have a “framework that is responsive to social demands and changes in the business environment, while leveraging the strength of our current structure,” considering that OMRON is currently in a transitional period, in which we aim to enter a growth phase after completing the structural reform. Among other matters, we especially focused on further enhancement of shared interest with shareholders to further incentivize officers to commit to the improvement of corporate value over the medium to long term. We aimed to establish a new compensation plan that balances autonomous efforts by officers to take on challenges with sustainable corporate growth, while being responsive to changes in the external environment.

Item

Revision

Evaluation weight

Indicators

80%

Relative TSR*

20%

Specific indicators will be determined after deliberations of the Compensation Advisory Committee, in light of the medium-term management plan.

* Indicator that compares total shareholder return (TSR) of OMRON in the covered period to the percentage change of TOPIX, dividends included (Relative TSR = TSR Г· Percentage change of TOPIX, dividends included)