Japan’s industrial sector is facing increasingly serious labor shortages caused by the declining birthrate and population aging, which are creating the need for stable operations with limited resources through greater efficiency. In particular, in the distribution and retail industries, labor shortages are compounded by the growing complexity of store operations due to diversifying consumer needs, and demand for solutions to address these challenges is expected to continue.

On the environmental front, the global average temperature in 2024 reached 1.5В°C above pre-industrial levels, and the probability that this threshold will be exceeded within the next five years is forecast at 47%*1. Against the backdrop of such climate change, social demand for the introduction of renewable energy continues to grow. The Ministry of the Environment has set a target of reducing greenhouse gas emissions from the residential sector by 66% in fiscal 2030 compared with fiscal 2013, and intends to promote improvements in residential energy efficiency, the introduction of renewable energy, energy-saving measures, and thorough energy management*2. Approximately 67.6% of CO2 emissions from the residential sector come from electricity use, and with the impact of soaring electricity prices, the introduction of solar power generation is attracting attention. Since the installation rate of residential solar power systems remains at only 6.3%, demand for solar power generation and energy storage systems for residential use in Japan, where SSB holds the top market share, is expected to grow*3. The social infrastructure market as a whole is expected to show steady growth in fiscal 2025.

*1 Source: World Meteorological Organization (WMO), State of the Global Climate 2024

*2 Source: Ministry of the Environment, Plan for Global Warming Countermeasures (approved by the Cabinet of Japan on October 22, 2021)

*3 Source: Ministry of the Environment, Survey on Actual CO2 Emissions from the Residential Sector (final results for fiscal 2023)

SSB’s strength lies in the extensive knowledge it has cultivated across a wide range of industries in the social infrastructure domain, as well as in its ability to provide value by combining products and systems, which are OMRON’s core strengths, with services. In each industry that supports social infrastructure, we have acted as a one-stop provider, offering proposals to address customers’ issues, installation, and after-sales services such as maintenance and operation support. In this way, we have stayed close to customers’ value chains and built relationships of trust. As a result, we have secured the top share in the domestic infrastructure market. Going forward, we will continue to leverage this strength and focus on providing value by combining products and services. For example, in energy solutions, in addition to supplying storage battery systems for residential use, where we have a strong presence, we are promoting the introduction of a service model known as a power purchase agreement (PPA), which eliminates the initial costs that had previously been a burden for customers. Through proposals tailored to each customer’s circumstances, we are working to resolve the challenges associated with renewable energy adoption. In management and service solutions (M&S), we support customers in industries such as distribution and retail that operate nationwide by assisting with the introduction of equipment at their sites. In addition, we provide comprehensive services that cover the maintenance and operation of various equipment installed, as well as inventory management and other tasks required for site operations. In this way, we are addressing issues such as improving operational efficiency at both the on-site and management levels and reducing equipment maintenance and operation costs. SSB will accelerate the resolution of customer issues by delivering solutions that combine products and services to diverse sites.

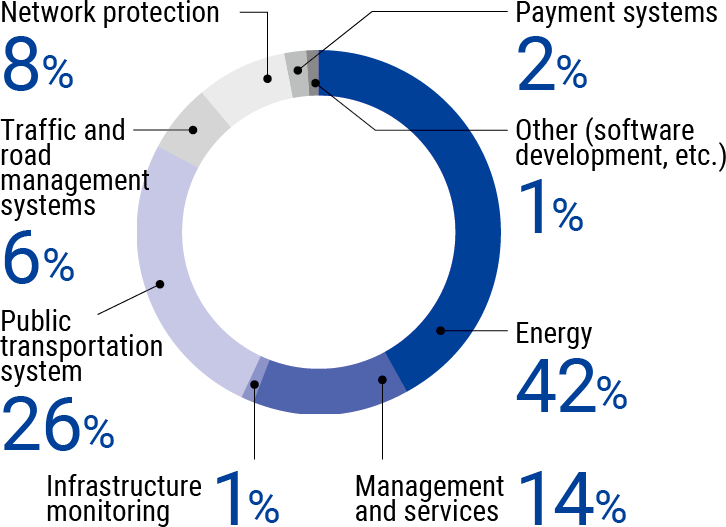

SSB’s vision under SF2030 is “Design Next Social Structure – Creating Social Good by Organically Linking People and Society through Social Automation.” This vision reflects our determination to continue designing next-generation social systems by responding to customer needs from the customer’s perspective and keeping a close eye on social issues. As initiatives for business growth, we are focusing on “Energy” and “Management and Services (M&S),” where the market is showing steady growth, as SSB’s medium- to long-term growth drivers, and will accelerate the provision of new solutions. In energy solutions, in addition to maintaining our top share in storage battery systems, we aim to achieve business growth exceeding market growth by enhancing added value through the creation of services and expanding the addressable market. Specifically, in addition to expanding the product lineup of storage battery systems, we are promoting offerings that combine them with services such as AI-based solutions that optimally control fluctuations in solar power generation and electricity consumption according to individual lifestyles. In M&S solutions, in addition to providing swift and uniform services by leveraging our nationwide maintenance network and offering multivendor support to customers regardless of their equipment manufacturer, we collect various data such as equipment operating status, inventory management, and customer behavior at the individual sites of customers operating across multiple locations. By utilizing this data to address issues not only in store operations but also in overall business operations, we aim to expand our business. While establishing the foundation for business growth, SSB will contribute to the spread and efficient use of renewable energy and to the sustainability of social infrastructure. By continuously designing next-generation social systems, we aim to create a brighter future through social good.

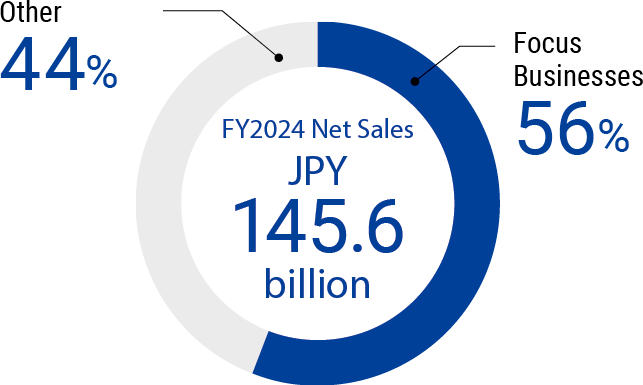

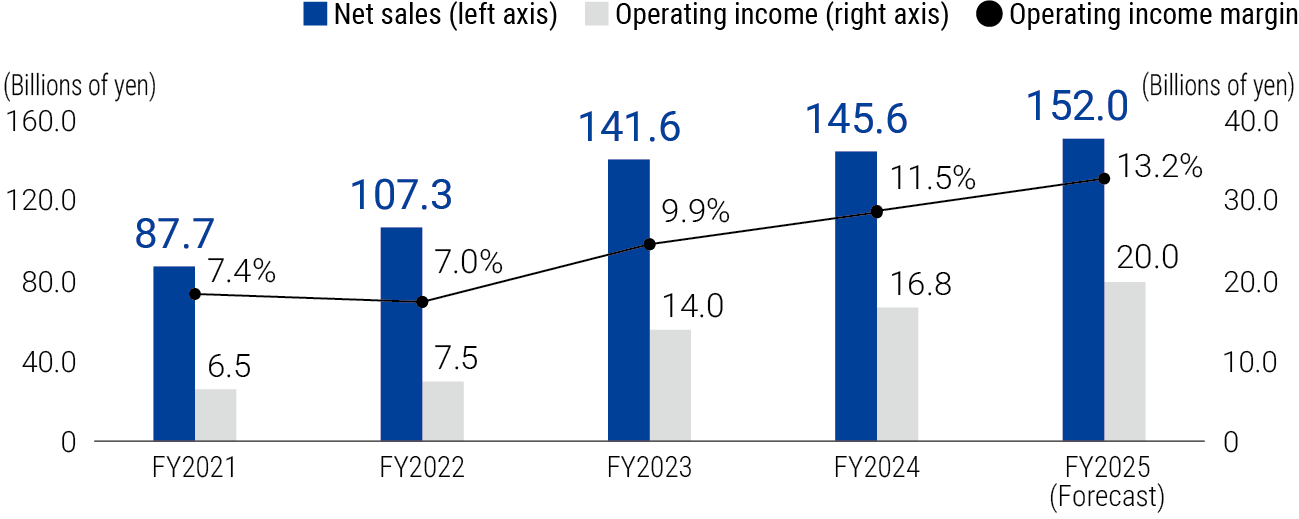

Net Sales for Fiscal 2024

The storage battery systems and other businesses within the energy solutions business performed well as a result of growing needs for captive consumption of renewable energy, utilization of subsidy programs, and continued progress in initiatives toward carbon neutrality in the industrial and commercial domains. The public transportation system business saw robust demand for capital investment by railway companies amid an increase in passenger numbers. As a result, sales increased year on year.

Operating Income for Fiscal 2024

Operating income increased significantly year on year, mainly due to the increase in sales.