According to an announcement by the Japan Electronics and Information Technology Industries Association (JEITA) , the global market size of the electronic device sector, including semiconductors and electronic components, is projected to exceed USD 1 trillion (approximately JPY 155 trillion) for the first time in 2025, driven by the broader use of AI and other factors. The energy and mobility market are also expected to continue expanding steadily, driven by investment in solar power generation systems, electric vehicles (EVs), and charging infrastructure.

In DMB’s focus markets, demand in fiscal 2025 is expected to expand for device inspection equipment in the semiconductor market due to the shift toward higher frequencies, as well as for high-frequency devices, driven by the expansion of communication infrastructure to support faster and higher-capacity communications. In the energy management market, demand is expected to increase for direct current (DC) conversion, higher capacity, and the safe interruption of large currents in solar power generation and storage systems, as well as in EV-related equipment.

Thus, reflecting the growing demand and medium- to long-term market growth in its focus businesses, DMB will continue to strengthen its approach to markets with ongoing growth potential and the creation of new products that address customer needs, aiming for business growth that outpaces the rate of market growth.

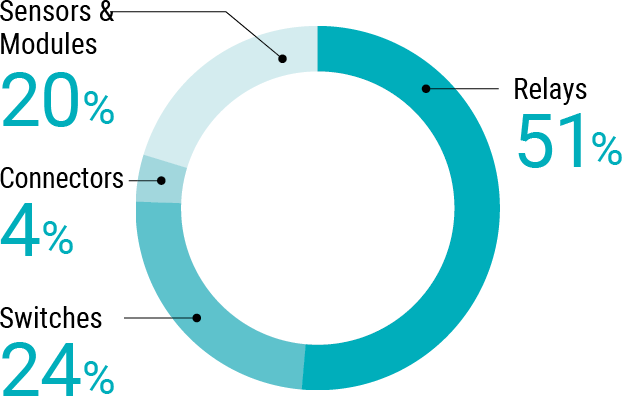

DMB has focused on enhancing functionality and improving quality of devices and modules such as relays, switches, connectors, and sensors since its founding, particularly centered on its core technologies in connecting and switching. With our proprietary microfabrication technology and the technology for enabling various functional features packed in a compact-sized product, we can create unique, highly functional and high-performance devices and modules that differ from those of specialist manufacturers. For example, the high-capacity power relay released in 2024 employs our manufacturing technologies cultivated through a wide range of electronic components, while also incorporating proprietary simulation analysis technologies. This has reduced heat generation during current conduction, which affects product life, while also raising the maximum switching voltage within the same size by approximately 30% compared with conventional products, leading to longer product life along with enhanced functionality and performance. Another strength of DMB lies in its sales network that provides solutions globally to meet the needs of leading companies across a wide range of industries, as well as the reliability of quality and technologies that we have continued to refine over many years.

In addition to these strengths, we have also been working to provide new value based on the concepts of “green,” “digital,” and “speed.” As part of our initiatives, in 2023 we launched the Green Project, which integrates the three areas of products, production processes, and purchase, and promotes initiatives to help customers achieve carbon neutrality across their entire value chain. In fiscal 2024, we completed the switch to renewable energy sources for electricity consumption at all DMB sites in Japan. Furthermore, starting in May 2024, we began calculating and providing carbon footprints based on global standards, mainly for products destined for Europe. DMB will continue to contribute to the realization of a decarbonized society through initiatives to lower environmental impact.

To achieve the goals of SF2030, DMB is focusing on establishing a self-driven growth structure and an earnings structure with a view to medium- to long-term business growth.

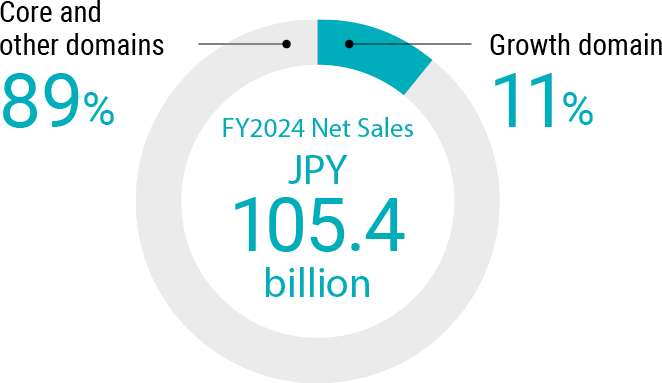

Our first focus is to create new pillars for growth. While steadily generating profits from components that serve as our earnings base, we are positioning new energy, EVs, and semiconductors as growth domains and fostering businesses that will become the next pillars of growth. Specifically, we are capturing growth in the markets driven by the shift to direct current and increased capacity in energy management systems, as well as the adaptation to higher frequencies in semiconductor and device testing equipment. To this end, we have designated six key products, including relays for DC devices and relays for high-frequency devices, and are strengthening product development. We will concentrate management resources in these domains with the aim of growing sales to JPY 50 billion, which accounts for 30% of DMB’s net sales by fiscal 2027. To respond quickly to local needs and further accelerate growth, we have strengthened our development structure for products targeting the local Chinese market. By eliminating prototype molds and repurposing dedicated equipment for general use, we have already achieved significant results, such as reducing the lead time for prototype processes to one-tenth of the previous level.

Our second focus is on the transition to a stable earnings structure that does not rely on cost control. Specifically, in addition to improving productivity through automation and labor-saving in manufacturing, we are working to improve procurement by raising the ratio of locally sourced materials and consolidating commercial logistics, and to enhance production efficiency by introducing statistical demand forecasting. Furthermore, we are strengthening our relationships with distributors, improving the supply framework by optimizing processes from production to delivery, and collaborating on the promotion of high-value-added products. Through these initiatives, we aim to rebuild a stable earnings base.

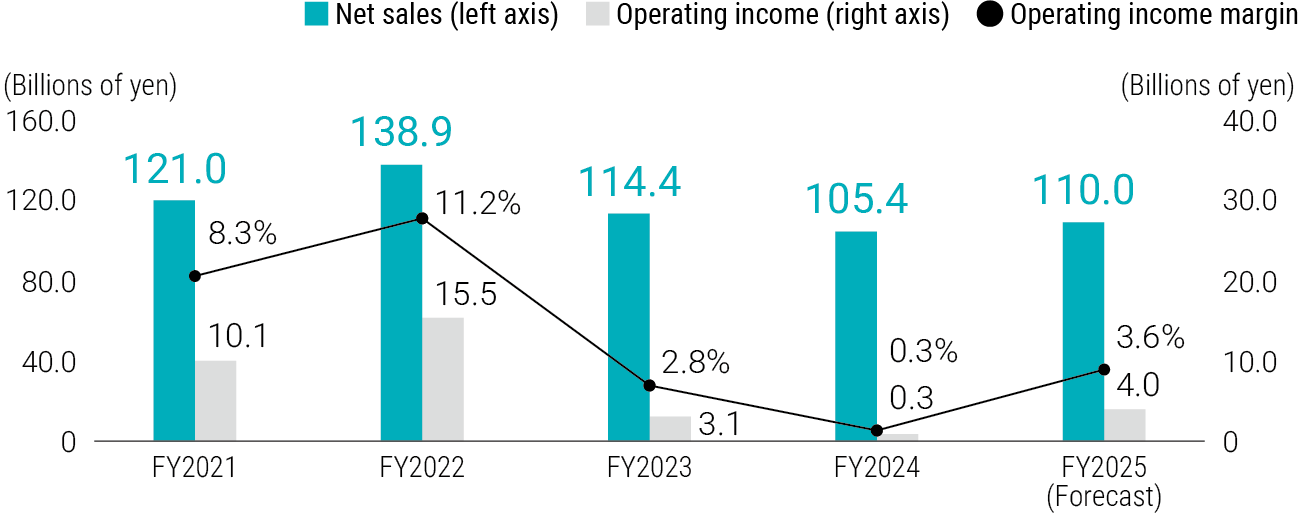

Net Sales for Fiscal 2024

Demand for components for the consumer industry showed signs of recovery in certain regions, such as China, and in some industries, including advanced semiconductors. However, in Europe and Japan, demand remained sluggish due to factors such as stagnant inventory digestion among customers and revisions to production plans. Demand for automotive components increased in China but was sluggish in Europe, reflecting revisions to EV incentive programs. As a result, net sales decreased year on year.

Operating income for Fiscal 2024

Operating income declined significantly year on year due to a decrease in sales, soaring raw material prices, and other factors.

* Fiscal 2024 sales of new products developed at the Shenzhen factory in China