OMRON’s corporate governance is defined as the system of processes and practices based on the OMRON Principles and the OMRON Management Philosophy with the ultimate objective to achieve sustained enhancement of corporate value by earning the support of all stakeholders.

Through this system, OMRON ensures transparency and fairness in business and speeds up management decisions and practices. This is done by organically connecting the entire process from oversight and supervision all the way to business execution in order to boost the OMRON Group’s competitive edge .

OMRON established the OMRON Corporate Governance Policies based on the Basic Stance for Corporate Governance. Since establishing the Management Personnel Advisory Committee in 1996, OMRON has spent more than 25 years formalizing and strengthening its framework of corporate governance. OMRON intends to continue our pursuit of ongoing improvement of corporate governance to achieve sustainable enhancement of corporate value.

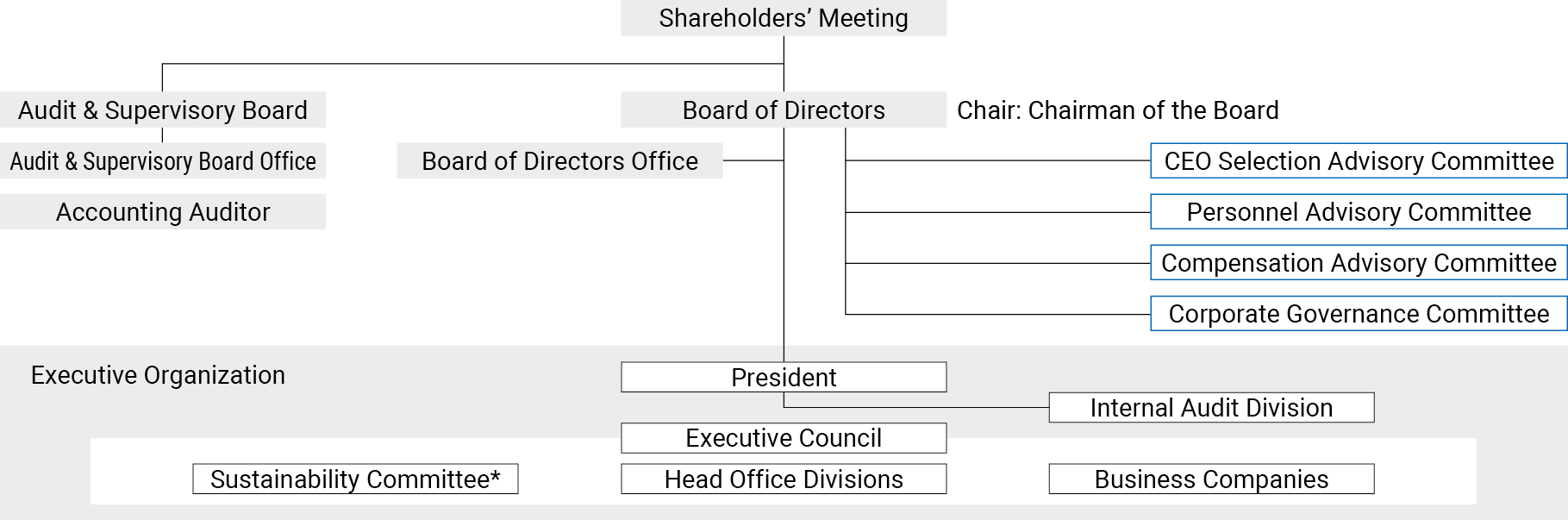

OMRON has elected to be a company with an Audit & Supervisory Board. The OMRON Board of Directors consists of eight members to ensure substantive discussion and deliberations. To increase objectivity on behalf of the Board of Directors, the titles and roles of the Chairman of the Board and President (CEO) have been separated. The Chairman serves as chair of the Board of Directors with no direct corporate representational authority. To enhance the oversight functions of the Board of Directors, OMRON has established the following committees: the CEO Selection Advisory Committee, the Personnel Advisory Committee, the Compensation Advisory Committee, and the Corporate Governance Committee.

* The Sustainability Committee identifies important issues relating to sustainability in the focus domains, the head office divisions, and various committees (the Corporate Ethics & Risk Management Committee, the Information Disclosure Executive Committee, and the Group Environment Activity Committee) and oversees them on a Group-wide basis.

In order to strengthen the supervision function of the Board of Directors, at OMRON, management oversight and business execution are kept separate, and a majority of the Board of Directors shall consist of Directors who are not involved with business execution. In addition, at least one-third of the Board of Directors shall consist of Outside Directors. Regarding Outside Directors and Outside Audit & Supervisory Board Members, from the perspective of ensuring their independence, they are elected in accordance with OMRON’s “Independence Requirements for Outside Executives .” Based on the above, the Board of Directors shall consist of diverse members who possess the experience, specialized knowledge, and insights necessary to realize the OMRON Group’s management vision and shall ensure diversity without distinction as to gender, nationality, international experience, or age.

The Company ensures transparency and fairness in business management, speeds up management decisions and practices, and strives to boost the OMRON Group’s competitive edge. The ultimate objective is to achieve sustained enhancement of corporate value. To this end, OMRON reinforces the supervisory functions of the Board of Directors through initiatives for improving its effectiveness.

Review and identify issues

Deliberate countermeasures and discuss disclosure draft

Confirm the final disclosure draft

Summary of FY2024

Given the downward revisions to the financial results made twice in fiscal 2023, the Board of Directors in fiscal 2024 considered monitoring of the progress toward accomplishing the Structural Reform Program NEXT 2025 to be the most important theme, and strengthened oversight and supervision over the progress of the five Structural Reform measures. In addition, the Board emphasized early information sharing and discussion regarding the status of operations and the business environment, to help resolve the following issues identified in fiscal 2023* and to enhance the predictability of business performance. Moreover, to achieve greater effectiveness of the Board of Directors’ activities as a whole, various new initiatives have been introduced. Specifically, we enhanced Informal Meetings and opinion exchanges between Directors and management executives, and increased opportunities for multifaceted discussions with business execution divisions, in order to allow for early deliberation on strategies and issues of each business. As a result, the Corporate Governance Committee commended the Board of Directors for having increased effectiveness in its overall activities, reflecting enhanced related activities other than the Board of Directors meetings.

* Issues identified in fiscal 2023

Points commended

Issues

Points requested

Toward resolving the issues, the Corporate Governance Committee made requests to the Board of Directors on the following points.

To that end, agenda items submitted to the Board of Directors meetings shall be examined, to determine new items to be discussed and those to be omitted.

в– Focus Theme 1

Progress monitoring toward accomplishing the Structural Reform Program “NEXT 2025”

в– Focus Theme 2

Progress monitoring toward realizing the long-term vision

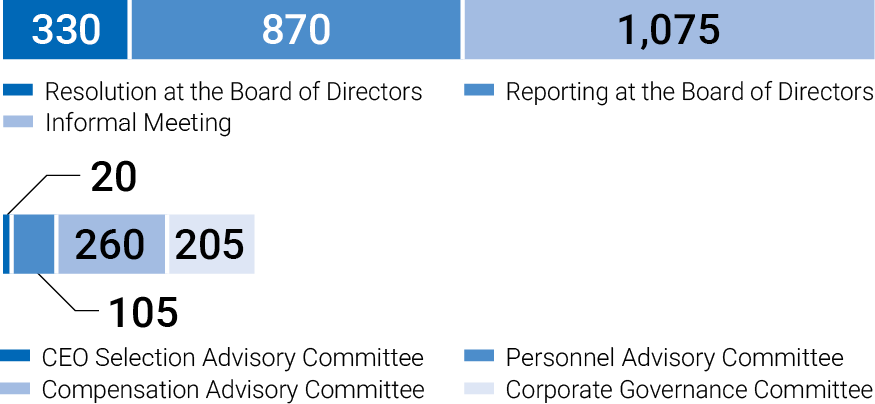

* Including agenda items for Informal Meetings and various committee meetings

Unit: minutes

Major agenda items for resolution

Major agenda items for reporting

Agenda items of Informal Meetings

In fiscal 2024, we have actively set up an Informal Meeting, to bring active discussions between the Board of Directors and the business execution division from an early phase, over the themes of business strategies and important Structural Reform measures. We also provided to Outside Executives more opportunities for exchanging opinions with the President of each Business Company, to help them better understand the strategies and initiatives of each business.