Please tell us about the roles expected of OMRONвАЩs Compensation Advisory Committee.

The Compensation Advisory Committee places emphasis on two roles toward maximizing corporate value. The first is to design incentives that encourage bold challenges by officers who strive to realize the long-term vision while embodying the OMRON Principles, thereby promoting contributions to sustainable growth and the enhancement of corporate value over the medium to long term. The second is to ensure transparency and objectivity through the disclosure of the officer compensation plan , thereby deepening stakeholdersвАЩ understanding of OMRONвАЩs management approach and stance. To fulfill these two roles, the Chairperson and a majority of the Committee Members are independent Outside Directors. The Committee deliberates and makes recommendations from an independent standpoint regarding the policies and levels of compensation for Directors and Executive Officers. We believe that strengthening the supervisory function of the Board of Directors, as well as enhancing stakeholdersвАЩ trust and confidence in OMRONвАЩs corporate governance, including the compensation plan, is an important mission assigned to the Compensation Advisory Committee.

Please tell us about the purpose and key points of the recent revision to the compensation plan.

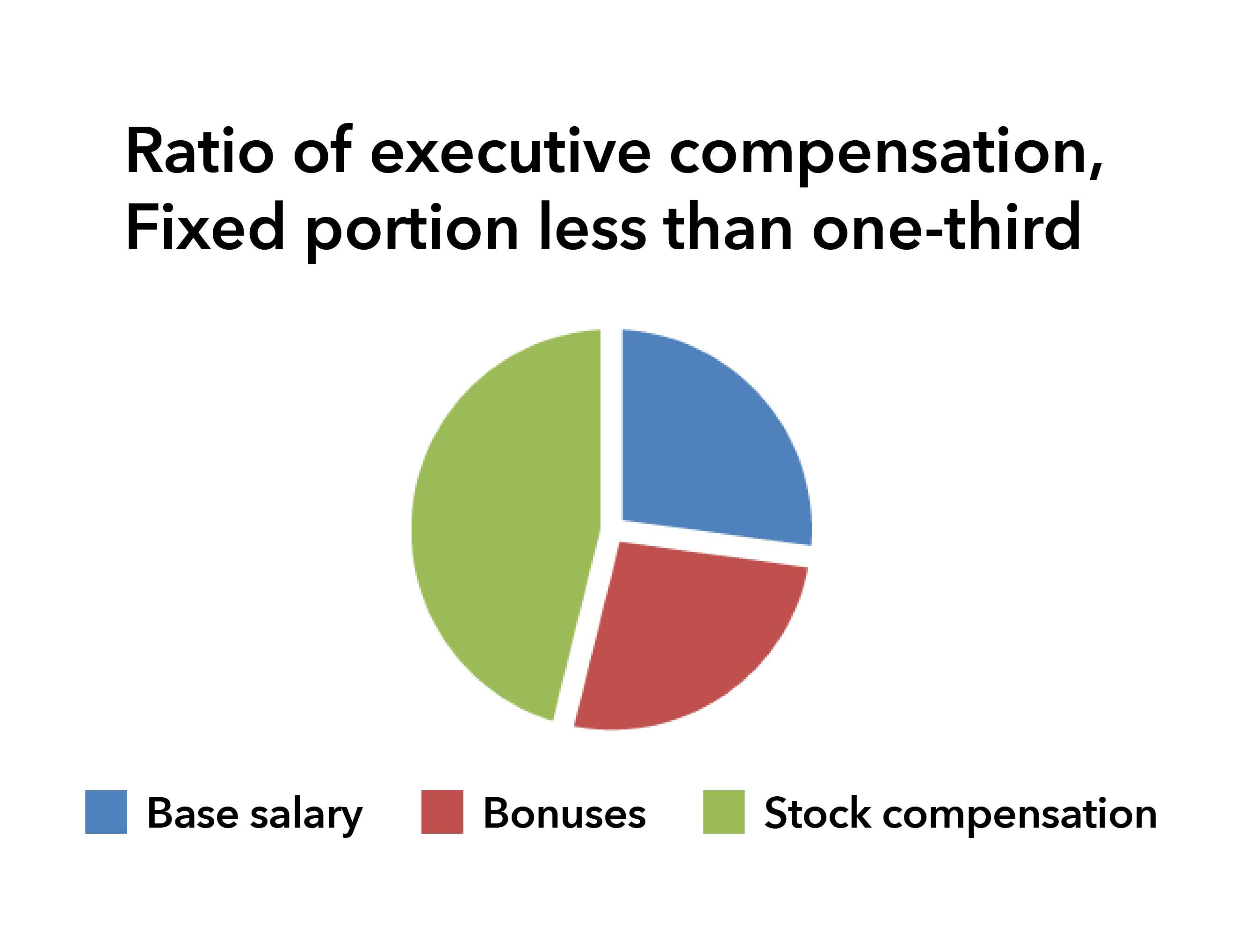

OMRONвАЩs officer compensation is designed as a framework to enhance the motivation to contribute to the вАЬrealization of sustainable growthвАЭ and вАЬimprovement of corporate value over the medium to long term,вАЭ while encouraging appropriate risk-taking. We also aim to establish a compensation structure and level that combine competitiveness and persuasiveness to enable the acquisition and retention of excellent human resources. Based on these policies, officer compensation consists of three components: вАЬBase salary (fixed),вАЭ вАЬShort-term performance-linked compensation (bonuses),вАЭ and вАЬMedium-to-long-term performance-linked compensation (stock compensation).вАЭ OMRON places importance on building an вАЬOMRON-styleвАЭ compensation structure that is rooted in the practice of the OMRON Principles. Accordingly, sustainability indicators are incorporated into the medium-to-long-term performance-linked compensation (stock compensation). In addition, by increasing the relative weight of the medium-to-long-term performance-linked compensation (stock compensation), we have created a mechanism that emphasizes the evaluation of contributions to the enhancement of corporate value and the creation of social value over the medium to long term, thereby strengthening officersвАЩ motivation.

Please tell us about the purpose and key points of the recent revision to the compensation plan.

Since the evaluation period for the current medium-to-long-term performance-linked compensation (stock compensation), which began in fiscal 2021, would conclude at the end of fiscal 2024, we viewed this as an opportunity to review the entire compensation plan.

With the cooperation of external experts, we investigated the latest trends in compensation systems in Japan and overseas, identified issues, and held extensive discussions. Given that OMRON is currently in a вАЬtransition phase,вАЭ shifting from structural reform to a growth phase, this revision focused on two main points. The first is to establish a compensation plan capable of responding swiftly and flexibly to a rapidly changing external environment. The second is to provide incentives that encourage the management teamвАЩs proactive value creation toward the realization of the SF2030 Vision. Specifically, for short-term performance-linked compensation (bonuses), we revised the decision-making process for determining the calculation standards, from a resolution at the General Meeting of Shareholders to a process whereby the Board of Directors makes the decision based on the recommendation of the Compensation Advisory Committee. This revision strengthens the linkage with performance and allows more flexible responses to changes in the external environment. Next, regarding medium-to-long-term performance-linked compensation (stock compensation), we made two major changes: (1) shortened the evaluation period from four years to two years, and (2) newly introduced stock compensation for Outside Directors. The shortening of the evaluation period reflects the current phase, which requires prompt decision-making and early achievement of results under structural reform. The stock-based compensation will be calculated based on evaluations every two years and granted upon retirement, including the performance-linked portion, to prevent excessive focus on short-term results and to heighten awareness of corporate value enhancement throughout an officerвАЩs term. The introduction of stock compensation for Outside Directors aims to further strengthen their awareness of long-term corporate value enhancement by enabling them to view corporate value from the same perspective as shareholders. As the compensation for Outside Directors will consist only of stock compensation that is not directly linked to performance, it will encourage their involvement in management oversight and corporate value enhancement from a medium- to long-term perspective, without being influenced by short-term business results. This revision is of great significance not only in terms of strengthening governance but also in fostering a sense of unity with stakeholders and securing outstanding external human resources. Furthermore, the revised system features a compensation composition ratio tailored to each position and role. For example, under the new system, in the case of the President and CEO, when the base salary is set at вАЬ1,вАЭ the stock compensation is set at a level of вАЬ1.7,вАЭ meaning that stock compensation accounts for about half of the total compensation. This clearly reflects the idea that вАЬthe enhancement of corporate value is the CEOвАЩs foremost mission.вАЭ As shown in the pie chart below, this results in a strategic compensation design in which fixed compensation accounts for less than one-third of total compensation, while variable compensation linked to performance and shareholder value represents a higher proportion.

What kind of discussions took place regarding the revision of the compensation plan during the structural reform period?

Yes, there were active discussions. There were two main points of debate. The first was whether the compensation plan should be revised while structural reform, positioned as continuing through the end of September 2025, was still underway. Ultimately, we decided to postpone any fundamental overhaul in order to ensure consistency with the вАЬSF 2nd StageвАЭ of SF2030. The second point concerned the importance of appropriately evaluating and rewarding managementвАЩs efforts and achievements amid ongoing recovery in business performance. As a result, the current revision was positioned as a вАЬtransitional adjustmentвАЭ accompanying the shift from structural reform to the growth phase, designed to balance motivation maintenance with sustainable growth for the future. Looking ahead, we will continue to examine and deepen discussions on what kind of compensation plan will best contribute to the enhancement of corporate value, keeping in mind the full-scale rollout of the вАЬSF 2nd StageвАЭ of SF2030.

How do you think OMRONвАЩs corporate governance should evolve and be strengthened going forward to realize sustainable growth?

OMRON has enhanced the speed and efficiency of management by promoting delegation of authority to the executive side while evolving into a вАЬhybridвАЭ corporate governance structure, one that combines the advantages of a company with an Audit & Supervisory Board and those of a company with a Nominating Committee, etc. At the same time, given the increasing uncertainty in the management environment, we believe that further evolution of corporate governance is essential to ensure the realization of sustainable growth, rather than remaining complacent with the current system.

In September 2025, OMRONвАЩs structural reform will reach a milestone, and we will enter the next Medium-term Management Plan, the вАЬSF 2nd Stage,вАЭ aimed at realizing the Long-term Vision вАЬSF2030,вАЭ or the вАЬre-growth phase.вАЭ In this new phase, in order to make the most of President TsujinagaвАЩs leadership and further enhance management speed and flexibility, it is important to further strengthen the Board of DirectorsвАЩ monitoring function. As one option, we believe that the time has come for the Board of Directors to seriously consider transitioning to a monitoring-model type of organizational structure. Going forward, we will continue careful discussions on what governance framework would be optimal for realizing SF2030 and will work toward further evolution.

We believe that the evolution of governance contributes to the enhancement of corporate value over the medium to long term. We will continue to build even stronger governance to meet the expectations of our shareholders, institutional investors, and all other stakeholders.