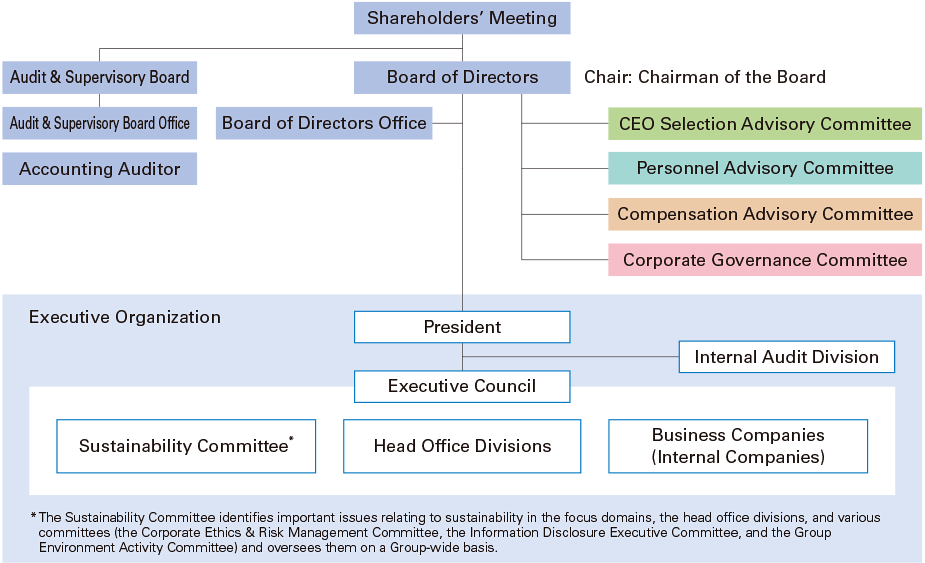

Corporate Governance Framework

Organizational Structure

OMRON has chosen to adopt the organizational structure of a "Company with Audit & Supervisory Board."

Board of Directors strives for sustainable enhancement of the OMRON Group's corporate value by exercising oversight over overall management through the election of directors, Audit & Supervisory Board members, and executive officers; the determination of compensation for directors and executive officers; and making important operational decisions.

Audit & Supervisory Board and Audit & Supervisory Board members work to secure the integrity of the OMRON Group and achieve the sustainable enhancement of corporate value by conducting audits on legality and appropriateness of directors' duties, and the fulfillment of Board of Directors' oversight obligations. In addition, each Audit & Supervisory Board member can exercise his/her authority on his/her own as a single-person organ in which the power over final decision-making is given to one person. This allows them to play a crucial role in strengthening internal controls.

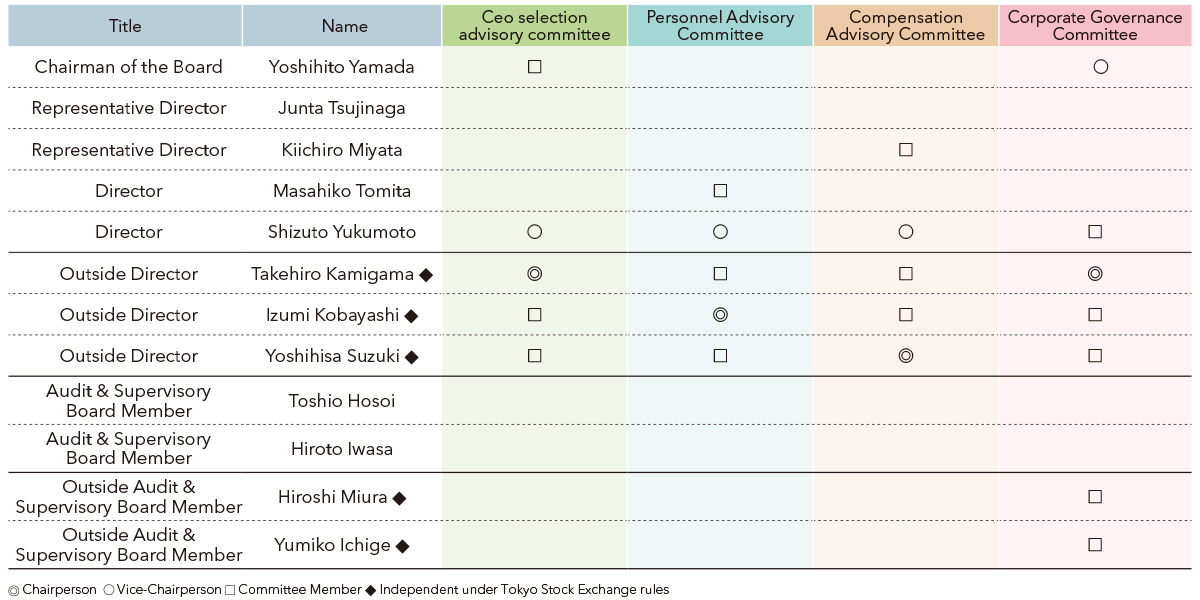

Furthermore, to enhance the oversight functions of Board of Directors, four voluntary advisory committees are attached to Board of Directors. The President & CEO does not belong to any of these committees. CEO Selection Advisory Committee, Personnel Advisory Committee, and Compensation Advisory Committee are chaired by an independent outside director, and a majority of each committee's members shall be composed of independent outside directors. CEO Selection Advisory Committee is dedicated to the deliberation and nomination of candidates for CEO, which is the top-priority matter in management oversight. In addition, the Corporate Governance Committee, established for the purpose of enhancing corporate governance, is to be chaired by an independent outside director, and its members to consist of independent outside directors, independent outside Audit & Supervisory Board Members, and non-executive inside directors. Through these unique initiatives, OMRON has established and adopted a system that enhances the transparency and objectivity of management's decision-making process.

By incorporating the best aspects of the corporate governance system of a "Company with Committees (Nomination, etc.)," OMRON has created the kind of hybrid corporate governance structure that we feel is most appropriate for OMRON as a "Company with Audit & Supervisory Board."

OMRON's Corporate Governance Structure

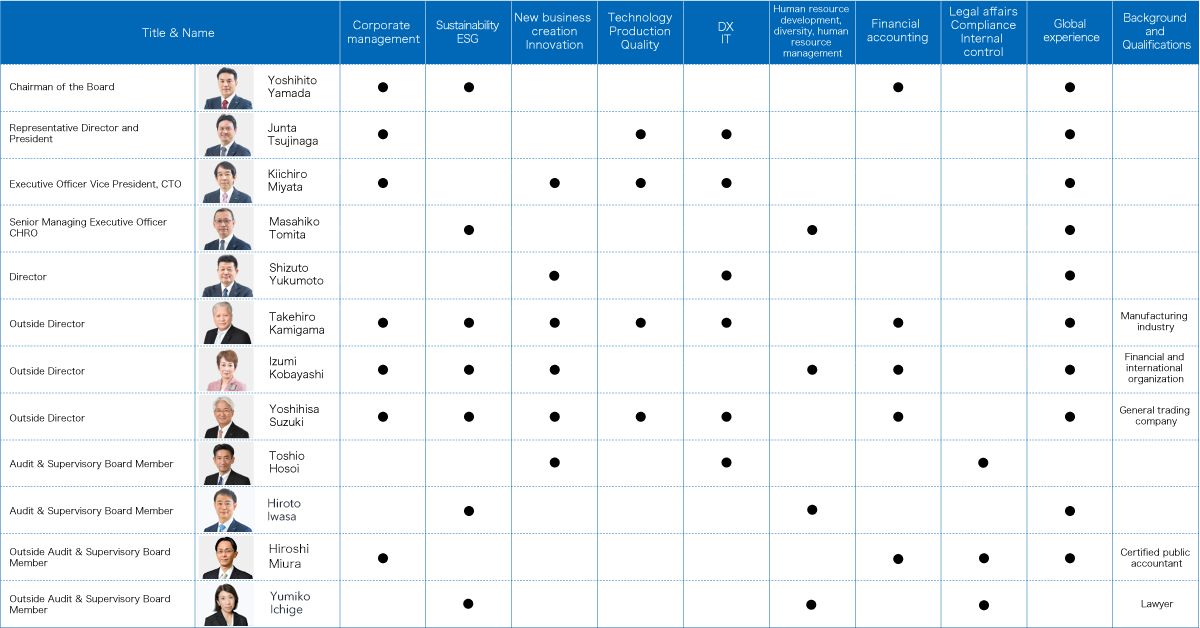

Main Areas of Expertise and Specialization of Directors and Audit & Supervisory Board Members (Skill Matrix)

Areas of expertise and specialization (skills) required for Directors and Audit & Supervisory Board Members for the realization of the long-term vision ŌĆ£SF2030ŌĆØ are as follows.

| Areas of expertise and specialization (skills) | Definitions of skills |

|---|---|

| Corporate management | Experience as Chairman/President or equivalent experience (experience as Representative Director, etc.) |

| Sustainability, ESG | Possesses business, management experience, and specialized knowledge related to sustainability and ESG |

| New business creation, innovation | Possesses business, management experience, and specialized knowledge related to new business and innovation |

| Technology, production, quality | Possesses business, management experience, and specialized knowledge related to technology, production, and quality |

| DX, IT | Possesses business, management experience, and specialized knowledge related to DX and IT |

| Human resource development, diversity, human resource management (third-party evaluation) | Possesses business, management experience, and specialized knowledge related to human resource development, diversity, and human resource management |

| Financial accounting | Qualified as a CPA, CFO experience, business experience in financial institutions and accounting departments, and listed company management experience |

| Legal affairs, compliance, internal control | Qualified as an attorney, experience as an auditor, work experience in legal and internal audit departments |

| Global experience | Global experience, overseas business experience |

*Three years of experience or more is required in principle

The skill matrix of Directors and Audit & Supervisory Board Members for fiscal 2025 is as follows.

Board of Directors

Directors

Yoshihito Yamada

Chairman

Chair of the Board of Directors

Vice Chairman of the Corporate Governance Committee

Member of the CEO Selection Advisory Committee

Junta Tsujinaga

Representative Director

Kiichiro Miyata

Representative Director

Member of the Compensation Advisory Committee

Masahiko Tomita

Director

Member of the Personnel Advisory Committee

Shizuto Yukumoto

Director

Vice Chairman of the CEO Selection Advisory Committee

Vice Chairman of the Personnel Advisory Committee

Vice Chairman of the Compensation Advisory Committee

Member of the Corporate Governance Committee

Outside Directors

Takehiro Kamigama

Outside Director

Chairman of the CEO Selection Advisory Committee

Chairman of the Corporate Governance Committee

Member of the Personnel Advisory Committee

Member of the Compensation Advisory Committee

Izumi Kobayashi

Outside Director

Chairman of the Personnel Advisory Committee

Member of the Corporate Governance Committee

Member of the CEO Selection Advisory Committee

Member of the Compensation Advisory Committee

Yoshihisa Suzuki

Outside Director

Chairman of the Compensation Advisory Committee

Member of the CEO Selection Advisory Committee

Member of the Personnel Advisory Committee

Member of the Corporate Governance Committee

Roles and Responsibilities

The Board recognizes its fiduciary responsibility to shareholders and assumes the responsibility of sustainably improving the OMRON Group's corporate value through appropriate exercise of its authority. To fulfill the above responsibilities, the Board exercises oversight functions over the overall management in order to ensure fairness and transparency of management practices. The Board does so through election of directors, Audit & Supervisory Board members, and executive officers. It also determines compensation for directors and executive officers, and makes important operational decisions. The Board is also responsible for establishing a system to respond to cases when Audit & Supervisory Board members or external auditors have discovered fraud within the OMRON Group and demanded appropriate remedies or pointed out deficiencies or problems.

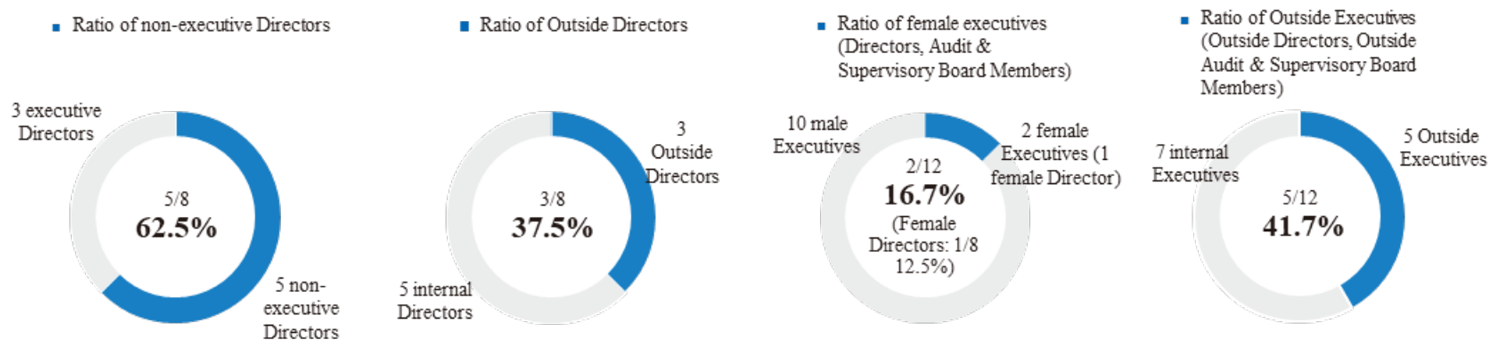

Policy regarding Composition of the Board of Directors

In order to strengthen the supervision function of the Board of Directors, at the Company, management oversight and business execution are kept separate, and a majority of the Board of Directors shall consist of Directors who are not involved with business execution. In addition, at least one-third of the Board of Directors shall consist of Outside Directors. Regarding Outside Directors and Outside Audit & Supervisory Board Members, from the perspective of ensuring their independence, they are elected in accordance with the CompanyŌĆÖs ŌĆ£Independence Requirements for Outside Executives.ŌĆØ Based on the above, the Board of Directors shall consist of diverse members who possess the experience, specialized knowledge, and insights necessary to realize the OMRON GroupŌĆÖs management vision and shall ensure diversity without distinction as to gender, nationality, international experience, or age.

Policy regarding Appointment of Directors and Audit & Supervisory Board Members

- Directors, Audit & Supervisory Board Members, and Executive Officers are composed of human resources with the experience, specialized knowledge and insight necessary for the realization of the management vision.

- To swiftly respond to the need for global-scale growth and greater competitive strength, as well as significant changes in the business environment, the Personnel Advisory Committee shall work to ensure diversity in the Board of Directors, Audit & Supervisory Board, and among executive officers in terms including work experience, specialized knowledge, insights, gender, nationality, international experience, and age.

- The experience, specialized knowledge, and insight necessary for the realization of the management vision related to Directors and Audit & Supervisory Board Members is presented in the skill matrix.

[Criteria for Appointment of Outside Directors]

- Outside Directors are deeply involved in the CEO Selection Advisory Committee, which specializes in matters such as the appointment of the President, which is the top-priority matter in management oversight. In order to establish a highly transparent and objective system for appointing a President and CEO, Outside Directors must have management experience or equivalent experience.

[Criteria for Appointment of Outside Audit & Supervisory Board Members]

- Audit & Supervisory Board Members must possess the necessary insight, high ethical standards, fairness, and integrity as an Audit & Supervisory Board Member, as well as specialized knowledge in law, finance, accounting, management, or other areas.

Composition of the Board of Directors

The composition of the Board of Directors for fiscal 2025 is as follows.

Meeting Attendance

In order to make sure that the Board of Directors effectively fulfill its roles and┬Āresponsibilities, all Directors and Audit & Supervisory Board members are required to┬Āmaintain the target attendance rate of 75% or higher.

The meeting attendance for fiscal 2024 is as follows.

| Position | Name | Attendance |

|---|---|---|

| Chairman of the Board | Yoshihito Yamada | 100%’╝ł12/12 times’╝ē |

| Representative Director | Junta Tsujinaga | 100%’╝ł12/12 times’╝ē |

| Representative Director | Kiichiro Miyata | 100%’╝ł12/12 times’╝ē |

| Director | Masahiko Tomita | 100%’╝ł12/12 times’╝ē |

| Director | Shizuto Yukumoto | 100%’╝ł12/12 times’╝ē |

| Outside Director | Takehiro Kamigama | 100%’╝ł12/12 times’╝ē |

| Outside Director | Izumi Kobayashi | 91.7%’╝ł11/12 times’╝ē |

| Outside Director | Yoshihisa Suzuki | 100%’╝ł12/12 times’╝ē |

| Audit & Supervisory Board Member | Shuji Tamaki | 100%’╝ł12/12 times’╝ē |

| Audit & Supervisory Board Member | Toshio Hosoi | 100%’╝ł12/12 times’╝ē |

| Outside Audit & Supervisory Board Member | Tadashi Kunihiro | 100%’╝ł12/12 times’╝ē |

| Outside Audit & Supervisory Board Member | Hiroshi Miura | 100%’╝ł9/9 times’╝ē |

| Outside Audit & Supervisory Board Member | Hideyo Uchiyama | 100%’╝ł3/3 times’╝ē |

’╝łNote’╝ēAt the conclusion of the 87th Ordinary General Meeting of Shareholders held on June 20, 2024, Mr. Hideyo Uchiyama retired from his position as Audit & Supervisory Board Member. Mr. Hiroshi Miura was also newly elected and appointed as Audit & Supervisory Board Member at the same meeting.

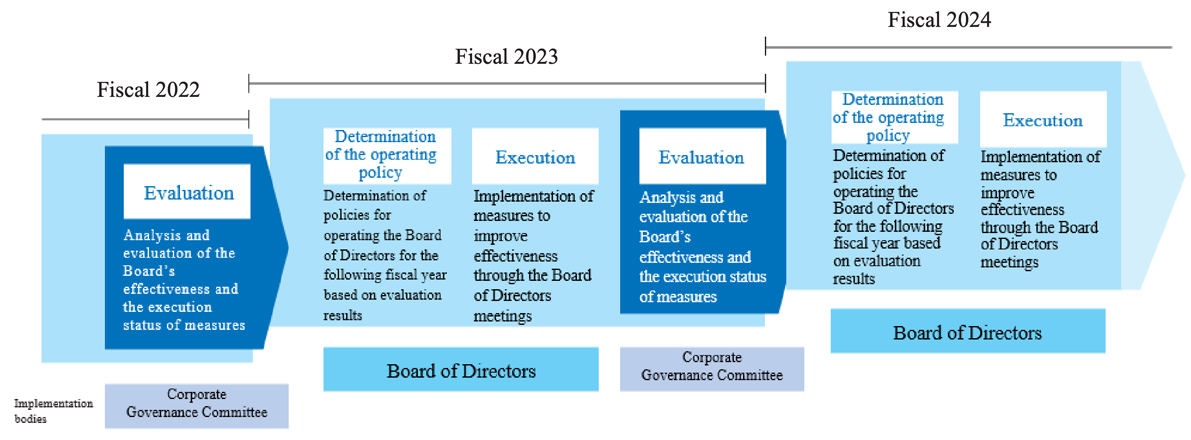

Status of initiatives towards improving Board of Directors' effectiveness

1. Overview of initiatives towards improving Board of DirectorsŌĆÖ effectiveness

The Company ensures transparency and fairness in business management, speeds up management decisions and practices, and strives to boost the OMRON GroupŌĆÖs competitive edge. The ultimate objective is to achieve sustained enhancement of corporate value. To this end, the Company reinforces the supervisory functions of the Board of Directors through initiatives for improving its effectiveness.

The Company performs the evaluation of the Board of DirectorsŌĆÖ effectiveness for the purpose of examining actual contribution made by the Board of Directors, identifying issues, devising countermeasures and promoting improvement, in order to ensure that corporate governance effectivelyfunctions. This evaluation is conducted by the Corporate Governance Committee chaired by an Outside Director and comprising Outside Directors and Outside Audit & Supervisory Board Members (hereinafter ŌĆ£Outside ExecutivesŌĆØ), as well as non-executive internal Directors. Outside Executives act as members of the Board of Directors while having the perspectives of all stakeholders including the shareholders. The Corporate Governance Committee, which is composed of Outside Executives and non-executive internal Directors, performs evaluations in order to ensure that evaluations are both objective and effective.Based on the evaluation results by the Corporate Governance Committee and the business environment, etc., the Board of Directors determines the policy for the operation and focus themes of the Board of Directors for the next fiscal year, and formulates and implements annual plans based on this operation policy.

Initiatives towards improving Board of Directors' effectiveness

For more information, see the following documents.

Audit & Supervisory Board

Audit & Supervisory Board Members

Toshio Hosoi

Audit & Supervisory Board Member

Hiroto Iwasa

Audit & Supervisory Board Member

Outside Audit & Supervisory Board Members

Hiroshi Miura

Outside Audit & Supervisory Board Member

Corporate Governance Committee Member

Yumiko Ichige

Outside Audit & Supervisory Board Member

Corporate Governance Committee Member

Roles and Responsibilities

Audit & Supervisory Board bears in mind its fiduciary responsibility to shareholders and works to secure the integrity of the OMRON Group toward sustainable enhancement of corporate value, and acts for the common interests of the shareholders. To fulfill the above-mentioned responsibility, Audit & Supervisory Board strives to develop a system to ensure effectiveness of audits conducted by each of its members. Audit & Supervisory Board works in collaboration with independent outside directors and the internal auditing department. Audit & Supervisory Board also exchanges views with independent outside directors and provides them with information acquired through auditing.

Meeting Attendance

The meeting attendance for fiscal 2024 is as follows.

| Position | Name | Attendance |

|---|---|---|

| Audit & Supervisory Board Member | Shuji Tamaki | 100%’╝ł13/13 times’╝ē |

| Audit & Supervisory Board Member | Toshio Hosoi | 100%’╝ł13/13 times’╝ē |

| Outside Audit & Supervisory Board Member | Tadashi Kunihiro | 100%’╝ł13/13 times’╝ē |

| Outside Audit & Supervisory Board Member | Hiroshi Miura | 100%’╝ł9/9 times’╝ē |

| Outside Audit & Supervisory Board Member | Hideyo Uchiyama | 100%’╝ł4/4 times’╝ē |

’╝łNote’╝ēAt the conclusion of the 87th Ordinary General Meeting of Shareholders held on June 20, 2024, Hideyo Uchiyama retired from his position as Audit & Supervisory Board Member and Hiroshi Miura was newly elected and appointed as Audit & Supervisory Board Member at the same meeting.

Composition

To effectively fulfill its duties and responsibilities, Audit & Supervisory Board is composed of members with experience, specialized knowledge, and deep insight in a well-balanced manner.

Principles of Conduct for OMRON Audit & Supervisory Board Members

Audit & Supervisory Board Members shall strive for self-improvement, be trustworthy at all times, uphold high ethical standards, and conduct themselves with humility.

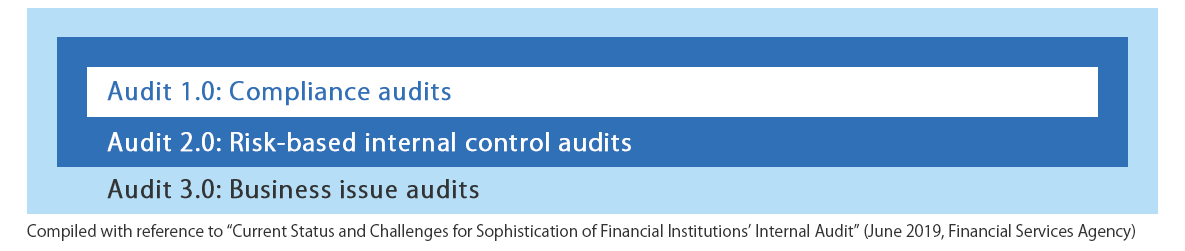

1. We not only conduct compliance audits (Audit 1.0) and point out deficiencies; but also conduct risk-based/internal control audits (Audit 2.0) and state our views; and conduct management issue audits (Audit 3.0) and provide advice.

2. We emphasize listening attentively, dialogue, and empathy,

(1) Ask questions with curiosity and discuss freely and openly.

(2) Express opinions vigorously, including harsh ones, and be persistent.

(3) Strive for objective, fair, and impartial discussion and opinions based on data and evidence.

3. In the spirit of "throwing stones to make waves," we question conventional wisdom inside OMRON from diverse perspectives, including those of stakeholders.

(1) Insight into the true causes and issues, not just the surface of things

(2) An inquiring mind based on a healthy skepticism that does not accept the status quo

(3) Assumption that there are two sides to everything (light and shade)

4. We promote behavioral changes in management that will enable future-oriented, transparent, fair, swift, and decisive decision-making.

Initiatives to increase the Audit & Supervisory Board effectiveness

1. Overview of the initiatives

To fulfill the responsibilities entrusted by stakeholders and to achieve sustained enhancement of corporate value, the Audit & Supervisory Board conducts audits as it consistently discusses how the auditing activities should be in OMRON.

While deepening compliance audits* and risk-based internal control audits,* the Audit & Supervisory Board also includes management issues within its audit scope.

* OMRON Audit & Supervisory Board refers to compliance audits, risk-based internal control audits, and management issue audits as Audit 1.0, Audit 2.0, and Audit 3.0, respectively.

Framework of Audit 3.0

2. Evaluation of the effectiveness

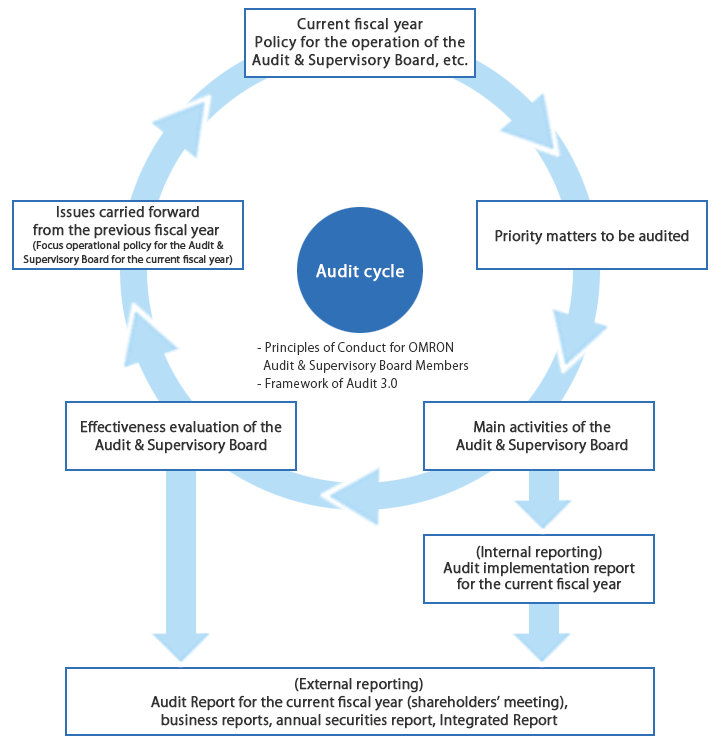

(1) Cycle of Audit Activities and Evaluation of Effectiveness

The Audit & Supervisory Board is working to enhance the effectiveness of the Audit & Supervisory Board Members by sharing and discussing management issues that each Audit & Supervisory Board member has identified through its annual activities and making recommendations to the Board of Directors. The effectiveness of these measures is evaluated at the end of the fiscal year.

Based on the evaluation results, the Audit & Supervisory Board formulates policies, priority audit items, and audit plans for the next fiscal year. In addition to the annual securities report, the evaluation results are also actively disclosed, such as in business reports, integrated reports, and on the Company's website.

(2) Results of the Audit & Supervisory Board's Effectiveness Evaluation

The Audit & Supervisory Board deepened compliance audits (Audit 1.0) and risk-based internal control audits (Audit 2.0), as well as actively audited areas of management issues (Audit 3.0) to evaluate the effectiveness of its activities from a more multifaceted and objective perspective.

The evaluation was conducted using the "Questionnaire for Audit & Supervisory Board Members," the "Evaluation Sheet for Contribution to Improving Corporate Value," and the "Audit Implementation Report for 2024." In addition, as in the previous fiscal year, the Audit & Supervisory Board Members received opinions from Directors and used them as references.

The "Evaluation Sheet for Contribution to Improving Corporate Value" is an original initiative of the Audit & Supervisory Board, which qualitatively analyzes statements made by Audit & Supervisory Board Members and determines the degree of contribution to the improvement of corporate value through the activities of the Audit & Supervisory Board. Specifically, we confirmed whether the activities of the Audit & Supervisory Board are contributing to the enhancement of corporate value in the following five stages for priority audit items. (1) Grasp the facts and data (2) Opinion of the Audit & Supervisory Board (3) Hypothesis development by the Audit & Supervisory Board (4) Discussion and recognition sharing at the Board of Directors meetings (5) Confirmation of the status of execution.

For more information, see the following documents.

Fiscal 2025 Advisory Committee

CEO Selection Advisory Committee

Roles

CEO Selection Advisory Committee has been established for the purpose of bolstering the management oversight function of Board of Directors by enhancing the transparency, objectivity, and timeliness of the decision-making process regarding nomination of candidates for CEO. CEO Selection Advisory Committee that specializes in selection of the President and appoints a candidate for the President and CEO for the next fiscal year, and deliberates about CEO succession planning and contingent succession planning to take over the position in emergency situations.

Composition

CEO Selection Committee is chaired by an independent outside director, and a majority of committee members shall consist of independent outside directors. The committee comprises Directors who are not engaged in business execution.

FY24 Activities and Activity Status

| CEO Selection Advisory Committee | |

|---|---|

| Members | Five members (three Outside Directors and two internal Directors) |

| Chair | Mr. Takehiro Kamigama, the lead Outside Director |

| Committee composition |

|

| Number of meetings held | 1 |

| Attendance rate | 100% |

| Matters deliberated and matters reported |

|

| Evaluation |

|

| Comments from the chair | In the second year in office as the President, Mr. Tsujinaga is in a difficult period of the structural reform, but we would like to ask him for continued efforts. We performed evaluation on the performance of the President and CEO and also held fruitful discussions on succession planning for the future. |

Personnel Advisory Committee

Roles

Personnel Advisory Committee has been set up for the purpose of bolstering the management oversight function of Board of Directors by enhancing the transparency, objectivity, and timeliness of the decision-making process regarding nomination of candidates for directors, Audit & Supervisory Board members, and executive officers. Personnel Advisory Committee sets criteria and policies relating to the selection of Directors, Audit & Supervisory Board Members and Executive Officers. The committee also deliberates about candidates.

Composition

Personnel Advisory Committee is chaired by an independent outside director, and a majority of committee members shall consist of independent outside directors. The committee comprises directors excluding Chairman and CEO.

FY24 Activities and Activity Status

| Personnel Advisory Committee | |

|---|---|

| Members | Five members (three Outside Directors and two internal Directors) |

| Chair | Ms. Izumi Kobayashi, Outside Director |

| Committee composition |

|

| Number of meetings held | 6 |

| Attendance rate | 100% |

| Matters deliberated and matters reported |

|

| Evaluation |

|

| Comments from the chair | In the fiscal year under review, incorporating the opinions of Committee members, we had discussions and made decisions that would contribute to enhancing effectiveness of the Board of Directors in the future, such as the partial delegation of authorities to CEO, a policy making regarding the composition of the Board of Directors based on business portfolios, and creation of a talent pool in line with that policy. |

Compensation Advisory Committee

Roles

Compensation Advisory Committee has been established for the purpose of bolstering the management oversight function of Board of Directors by enhancing transparency and objectivity in determining compensation amounts for each director and executive officer. Compensation Advisory Committee deliberates about compensation levels and amounts for Directors and Executive Officers, as well as setting compensation policies and carrying out compensation assessments.

Composition

Personnel Advisory Committee is chaired by an independent outside director, and a majority of committee members shall consist of independent outside directors. The committee comprises directors excluding Chairman and CEO.

FY24 Activities and Activity Status

| Compensation Advisory Committee | |

|---|---|

| Members | Five members (three Outside Directors and two internal Directors) |

| Chair | Mr. Yoshihisa Suzuki, Outside Director |

| Committee composition |

|

| Number of meetings held | 7 |

| Attendance rate | 97% |

| Matters deliberated and matters reported |

|

| Evaluation |

|

| Comments from the chair | In designing a transitional compensation plan suitable for the Structural Reform period, we discussed a constructive scheme from the perspectives of keeping executives motivated and giving them a long-term incentive. Going forward, we intend to discuss the design of a new compensation plan toward further increasing OMRONŌĆÖs corporate value. |

Corporate Governance Committee

Roles

Corporate Governance Committee has been established for the purpose of enhancing the transparency and fairness of management practices from the standpoint of all stakeholders and to continuously take steps to enhance corporate governance from a medium- to long-term perspective. Corporate Governance Committee discusses policies to continuously enhance corporate governance and to increase management transparency and fairness.

Composition

Corporate Governance Committee is to be chaired by an independent outside director, and its members to consist of independent outside directors, independent outside Audit & Supervisory Board Members, and non-executive inside directors.

FY24 Activities and Activity Status

| Corporate Governance Committee | |

|---|---|

| Members | Seven members (three Outside Directors,two Outside Audit & Supervisory Board Members and two non-executive internal Directors) |

| Chair | Mr. Takehiro Kamigama, the lead Outside Director |

| Committee composition |

|

| Number of meetings held | 7 |

| Attendance rate | 98% |

| Matters deliberated and matters reported |

|

| Evaluation | In order for each Director to demonstrate higher effectiveness, the Committee explicitly defined the roles of each Director and started self-evaluation of each Director from the fiscal year under review, to strengthen governance. |

| Comments from the chair | We deepened discussions on how to sophisticate the method for evaluating effectiveness of the Board of Directors during the fiscal year under review, and introduced selfevaluation of each Director. In the next fiscal year, we continue discussions on an optimal governance system for the Company, taking into account the mid- to long-term growth strategies and changes in the business environment. |

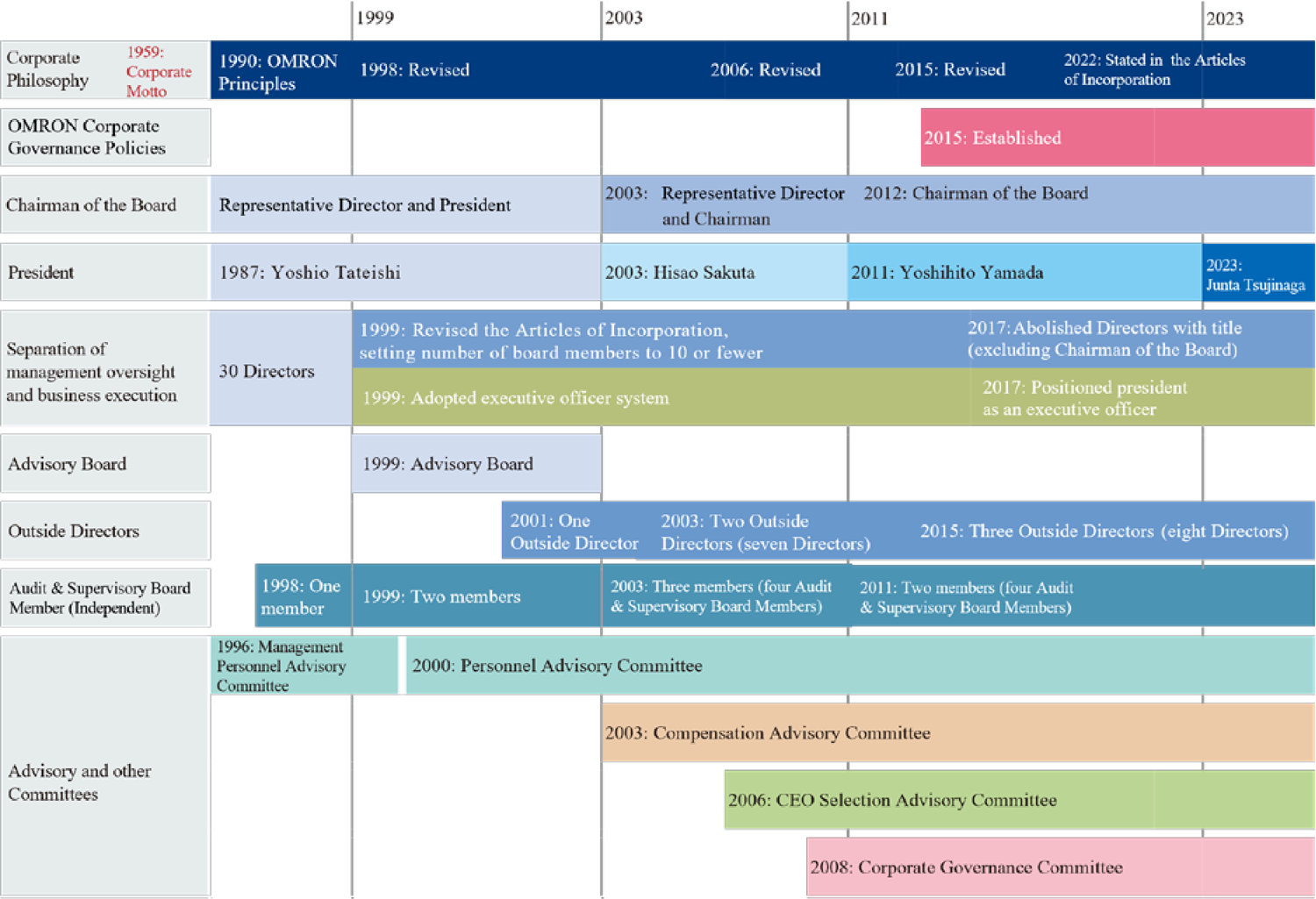

Corporate Governance Initiatives

Since establishing the Management Personnel Advisory Committee (now Personnel Advisory Committee) in 1996, OMRON has spent more than 20 years enhancing its corporate governance system. To achieve sustainable enhancement of corporate value, the Company will continue improving its corporate governance.