Compensation

Compensation for Directors, Executive Officers, and Audit & Supervisory Board Members

OMRON has set up Compensation Advisory Committee for the purpose of bolstering the management oversight function of Board of Directors by enhancing transparency and objectivity in determining compensation amounts for each director and executive officer.In response to a consultation request from the chairperson of Board of Directors, Compensation Advisory Committee deliberates on and makes recommendations regarding the Compensation Policy for Directors. Compensation Advisory Committee also deliberates on and determines the Compensation Policy for Executive Officers in response to a consultation request from the CEO. Reflecting the committee's recommendations, Board of Directors determines the Compensation Policy for Directors. Based on the above-mentioned respective Compensation Policy, Compensation Advisory Committee deliberates on compensation of Directors and Executive Officers. The amounts of compensation for individual Directors shall be determined by a resolution of Board of Directors, reflecting the recommendations of Compensation Advisory Committee. These amounts shall be within the maximum limit of the sum of compensation amounts for all directors, as set by a resolution of the General Meeting of Shareholders. The amounts of compensation for individual executive officers shall be determined according to the recommendations of Compensation Advisory Committee.

The amounts of compensation for individual Audit & Supervisory Board members shall be determined in accordance with the Compensation Policy for Audit & Supervisory Board Members, which is set forth through discussions among Audit & Supervisory Board members. These amounts shall be within the maximum limit of the sum of compensation amounts for all Audit & Supervisory Board members, as set by a resolution of the General Meeting of Shareholders.

Compensation Policy for Directors

- Basic policy

- The Company shall provide compensation sufficient to recruit as Directors exceptional people who are capable of putting the OMRON Principles into practice.

- The compensation structure shall be sufficient to motivate Directors to contribute to sustainable enhancement of corporate value.

- The compensation structure shall maintain a high level of transparency, fairness, and rationality to ensure accountability to shareholders and other stakeholders.

- Structure of compensation

- Compensation for Directors shall consist of a base salary, which is fixed compensation, and performance-linked compensation, which varies depending on the CompanyŌĆÖs performance.

- The compensation composition ratio of performance-linked compensation to base salary shall be determined according to each DirectorŌĆÖs role and responsibility.

- Compensation for Outside Directors shall consist of a base salary and non-performance-linked stock compensation, reflecting their roles and the need for maintaining independence.

- Base salary

- The amount of a base salary, paid monthly, shall be determined by taking into account the salary levels of other companies, as surveyed by a specialized outside organization.

- Performance-linked compensation

- As short-term performance-linked compensation, the Company shall provide bonuses linked to yearly performance indicators, and to the degree of achievement of performance targets. Bonuses shall be paid as a lump sum after the conclusion of the fiscal year.

- As medium- to long-term performance-linked compensation, the Company shall grant stock compensation linked to the improvement in corporate value (value of stock).The stock compensation shall be paid after the Director retires.

- Performance-linked stock compensation shall be paid upon the conclusion of a medium-term management plan, while non-performance-linked stock compensation will be paid after the individualŌĆÖs retirement from service.

- The Company shall determine the target amounts for short-term performance-linked compensation and medium-to-long-term, performance-linked compensation based on the target pay mix specified according to each DirectorŌĆÖs role and responsibility.

- Governance of compensation

- The compensation composition, compensation composition ratio, level of the base salary, as well as performance indicators and evaluation methods of performance-linked compensation shall be determined based on the deliberations and recommendations of the Compensation Advisory Committee.

Overview of Compensation Structure for Directors

(1)Compensation composition ratio

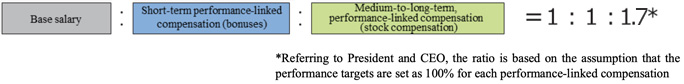

Compensation consists of a ŌĆ£base salaryŌĆØ (fixed compensation) and compensation according to Company performance, namely ŌĆ£short-term performance-linked compensation (bonuses)ŌĆØ and ŌĆ£medium-to-long-term, performance-linked compensation (stock compensation).ŌĆØ The ratio of compensation consisting of performance-linked compensation compared to base salary has been determined for each role:

(2)Base salary

A base salary is paid monthly to Directors as fixed compensation. Base salaries are determined for each role by taking into account the salary levels of officers at other companies (benchmarked companies of the same industry and scope selected by the Compensation Advisory Committee), as surveyed by a specialized outside organization.

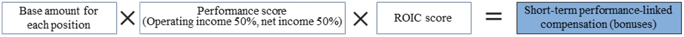

(3)Short-term performance-linked compensation (bonuses)

Bonuses are paid as a lump sum after the fiscal year concludes to Directors excluding Outside Directors as short-term performance-linked compensation, which is linked to yearly performance indicators and the degree of achievement of performance targets. Director bonuses varies according to the achievement of operating income, net income, and ROIC targets defined in the annual operating plan.

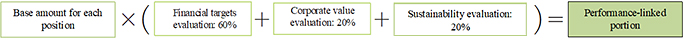

(4)Medium-to-long-term, performance-linked compensation (stock compensation)

Stock compensation is granted to Directors as medium-to-long-term, performance-linked compensation. Stock compensation consists of a performance-linked component (60%), which is linked to the achievement of performance targets during the applicable period, and a non-performance-linked component (40%), which is intended to promote retention and motivate Directors to enhance share prices over the medium to long term and is granted on the condition of serving a certain period (for Outside Directors, only the non-performance-linked component applies). Stock compensation is granted after retirement from office.

The performance-linked component fluctuates within a certain range depending on the degree of achievement of performance targets during the applicable period.

If a Director commits serious misconduct that causes damage to the Company during their term of office, the Compensation Advisory Committee will deliberate and make a recommendation, and, based on this, the Board of Directors may resolve to restrict the payment of stock compensation.

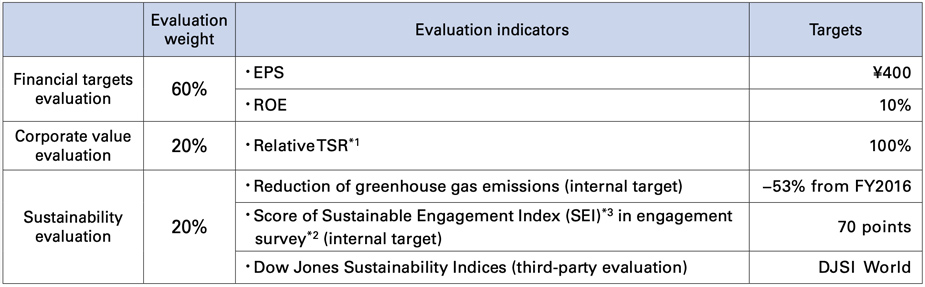

* Indicator that compares total shareholder return (TSR) of OMRON in the covered period to the percentage change of TOPIX, dividends included (Relative TSR = TSR ├Ę Percentage change of TOPIX, dividends included)

(5)Performance indicators of performance-linked compensation

- The performance indicators for short-term performance-linked compensation (bonuses) are set based on the financial targets defined in the short-term management plan.

- The performance indicators for medium- to long-term performance-linked compensation (stock compensation) are established from metrics for evaluating corporate value and sustainability, in order to achieve the CompanyŌĆÖs medium- to long-term and sustainable growth.

* A similar compensation policy and structure have been adopted for executive officers toward achieving medium- to long-term performance targets.

Compensation Policy for Audit & Supervisory Board Members

- Basic policy

- Compensation shall be sufficient to recruit exceptional people who are capable of performing the duties of Audit & Supervisory Board Members entrusted by shareholders.

- The compensation structure shall maintain a high level of transparency, fairness, and rationality to ensure accountability to shareholders and other stakeholders.

- Structure of compensation

- Compensation for Audit & Supervisory Board Members shall consist of a base salary only, reflecting their roles and the need for maintaining independence.

- Base salary

- The amount of a base salary, paid monthly, shall be determined by taking into account the salary levels of other companies, as surveyed by a specialized outside organization.

- Governance of compensation

- The amount of compensation for each Audit & Supervisory Board Member shall be determined through discussions by Audit & Supervisory Board Members.

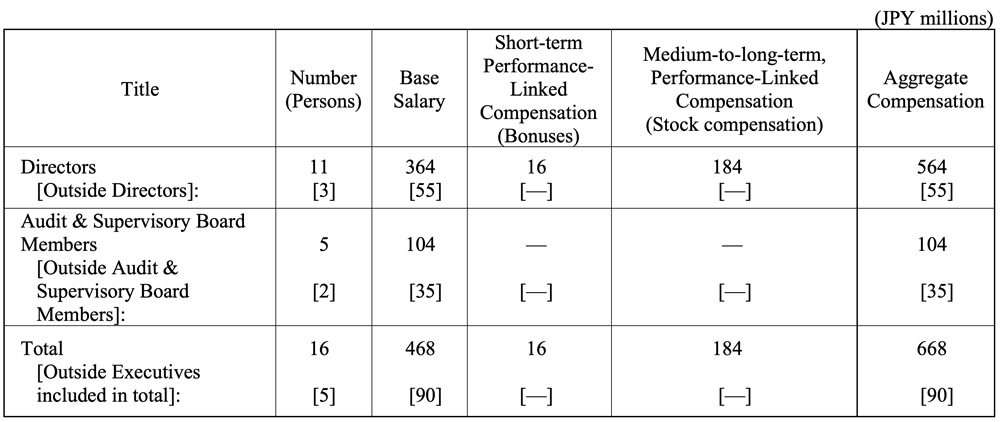

Fiscal 2024 Amount of Compensation of Directors and Audit & Supervisory Board Members

Notes:

- The amounts include compensation paid to one (1) Audit & Supervisory Board Member who retired at the close of the 87th Ordinary General Meeting of Shareholders held on June 20, 2024.

- The maximum limit of the aggregate compensation of Directors was set at JPY 35 million per month (by resolution of the 63rd Ordinary General Meeting of Shareholders held on June 27, 2000; the said resolution pertained to seven (7) Directors). The amounts of base salaries for each Director are determined by resolution of the Board of Directors based on discussions by and recommendations from the Compensation Advisory Committee.

- The maximum limit of the aggregate compensation of Audit & Supervisory Board Members was set at JPY 11 million per month (by resolution of the 81st Ordinary General Meeting of Shareholders held on June 19, 2018; the said resolution pertained to four (4) Audit & Supervisory Board Members). The amount of base salary for Audit & Supervisory Board Members is determined by discussions among Audit & Supervisory Board Members.

- The maximum limit of DirectorsŌĆÖ bonuses was set at JPY 600 million per year (by resolution of the 81st Ordinary General Meeting of Shareholders held on June 19, 2018; the said resolution pertained to five (5) Directors). The amount of bonus for each Director is calculated based on the targets and actual results of operating income, net income, and ROIC for the 88th term (fiscal year ended March 31, 2025), and determined by resolution of the Board of Directors based on discussions by and recommendations from the Compensation Advisory Committee. Regarding each indicatorŌĆÖs actual results, please refer to the graphs of trends in the consolidated performance (available in Japanese only).

- The 84th Ordinary General Meeting of Shareholders held on June 24, 2021 made a resolution to introduce stock compensation. Based on the resolution, the maximum limit of money to be contributed by the Company is JPY - 23 -2.4 billion, and the maximum limit of the number of the CompanyŌĆÖs shares to be granted and delivered as sales proceeds (ŌĆ£grant(ing), etc.ŌĆØ) is 600,000 shares during the four fiscal years from fiscal 2021 to fiscal 2024. The said resolution pertained to five (5) Directors. Regarding stock compensation, the Company shall award points to Directors calculated according to a prescribed formula, and the trust shall grant, etc. the CompanyŌĆÖs shares corresponding to the points awarded during a certain period to the Directors. The final calculation of the number of points to be granted and the actual delivery will be carried out after the end of the target period from fiscal 2021 to fiscal 2024, but the expenses of stock compensation, as indicated above, are associated with the points granted during the fiscal year under review. The amount of stock compensation for each Director is calculated based on the financial targets evaluation (EPS, ROE) from fiscal 2021 to fiscal 2024, the sustainability evaluation (reduction of greenhouse gas emissions, score of Sustainable Engagement Index (SEI) in engagement survey and Dow Jones Sustainability Indices) targets and achievements, as well as the corporate value evaluation (relative TSR), and determined by resolution of the Board of Directors based on discussions by and recommendations from the Compensation Advisory Committee. Regarding each indicatorŌĆÖs actual results, please refer to the graphs of trends in the consolidated performance (available in Japanese only) for evaluation on financial targets (EPS, ROE). The corporate value evaluation was made based on relative TSR (target: 100%, result:36.3%), and the sustainability evaluation was made based on reduction of greenhouse gas emissions (target: 53% reduction, result: 74% reduction), score of Sustainable Engagement Index (SEI) in engagement survey (target: 70 points, result: 69.5 points), and inclusion in DJSI World (selected for four years in a row).

- No Directors of the Company received any employee wages other than their compensation as Directors.